Tuesday Dec 17 2024 03:02

4 min

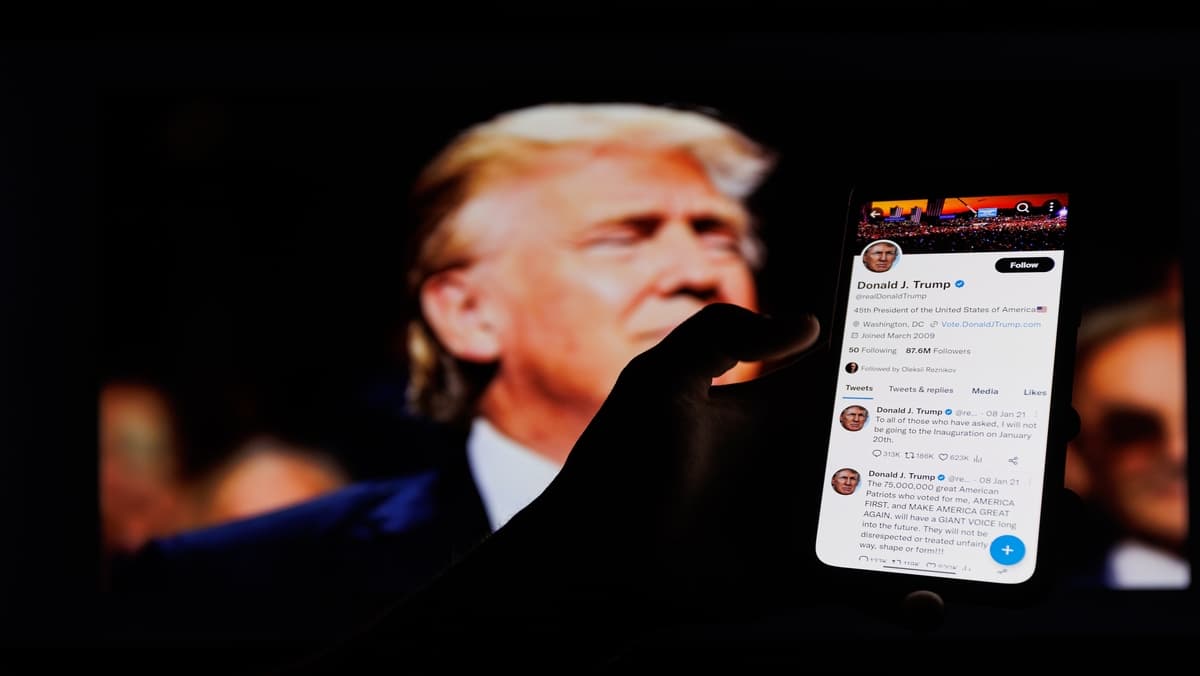

DJT stock performance analysis, DJT stock, closely associated with Donald Trump’s brand and ventures, exemplifies this volatility, understanding how to navigate the complexities of trading DJT stock is crucial for investors.

Understanding the historical performance of DJT stock price is critical for crafting a viable trading strategy. Analyze previous price movements, market trends, and pivotal events that impacted its valuation. Look for recurring patterns or seasonality that could suggest future behavior, and enhance this analysis with tools like candlestick charts and volume data. Historical metrics provide valuable insight into the stock's behavior and can guide more informed decision-making.

Since DJT stock performance may be influenced by broader economic and industry-specific variables, it is essential to stay updated on these factors. Monitor indicators like GDP growth, freight and transportation trends, and consumer demand fluctuations. Industry reports and government announcements can often signal potential market movements, offering traders a chance to act proactively.

How to trade djt stock effectively? Timing is everything in trading, and establishing clear entry and exit points can help maximize returns while reducing risk. Use technical indicators such as Fibonacci retracements or Bollinger Bands to pinpoint optimal buy and sell moments. Setting target prices and adhering to pre-planned thresholds ensures emotional decisions don’t derail your strategy.

Trading DJT stock effectively requires patience and a systematic approach. Avoid impulsively chasing gains or overreacting to market volatility. Instead, stick to your established plan and refine it as new data becomes available. Remember, a disciplined trader is often a wise one.

Utilize trading platforms that offer real-time data and customizable alerts to keep a constant pulse on DJT stock. By receiving notifications on key price levels or market developments, you can respond to opportunities quickly and with precision. Tools such as live order books and sentiment analysis can further enhance your strategy.

By exploring these strategies and maintaining a focus on risk management and research, traders can significantly improve their chances of successfully navigating the market and trading DJT stock effectively.

Trading DJT stock presents unique opportunities and challenges, driven by the intertwining factors of political developments, market sentiment, and economic conditions. By understanding the key influences on DJT stock performance and employing effective trading strategies—such as technical and fundamental analysis—investors can better position themselves in this volatile market.

Effective risk management is paramount; setting stop-loss orders, diversifying your portfolio, and staying informed about relevant news can help mitigate potential losses. Whether you choose to engage in day trading, swing trading, or long-term investing, maintaining a disciplined approach will help the trading. As with any investment, continuous learning and adaptation are essential for navigating the dynamic landscape of DJT stock.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.