Our trading platforms

You can trade on any instrument as long as you have enough funds in your account.

Make sure you check your available margin and the margin required for an instrument before you place a position.

After you’ve done so, you can open the position based on the free margin you have.

Find out more below.

You can find your account balance and other financial information at the top right corner of the markets.com platform (usually toggled through the “$” icon).

For financial details of your MT4/5 account, go to the top right corner menu and click on “My accounts”.

Bear in mind that the account balance shown does not reflect the profit or loss of open positions.

Find out more about margins in this section.

The required margin refers to the amount required for you to open a position and is derived through the following formula: (volume x current price) / leverage + (volume x spread) = total required margin.

Here’s an example: If you buy 10 barrels of oil at 51.30, then the calculation for the required margin is (10 x 51.30)/100 + (10 x 0.03) = 5.43 USD.

You can check out our CFD trading calculators too.

The used margin is the sum of the margin currently used for your open positions. It is calculated by adding up all of the initial margins of all of your open positions.

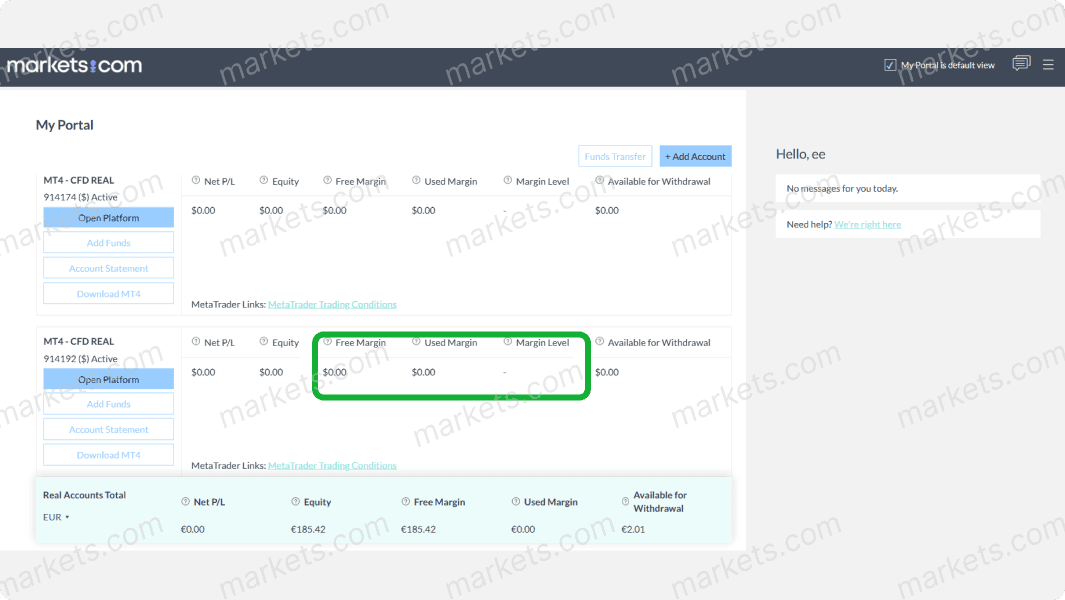

You can see the free margin, used margin, and margin level of your trading accounts when you log in and go to “My Portal”.

Here are some instances that need margins.

When trading CFDs, you need to maintain a certain margin level within your account to keep your positions open.

This margin is calculated as a percentage of the total value of your ongoing trades. If your margin falls below this level, then the system may start closing your trades to protect you from further losses - starting with the trade that has the biggest open loss.

Let’s say you decide to hedge your position, meaning to open a position in the opposite direction with the same quantity as your existing one.

Our system will only charge half of the margin required for your existing position and half of the margin required for the hedge position (exemptions apply)

This is a specific type of account offered solely to French clients due to regulatory requirements.

In light of consumer duty, new protections for less experienced UK FFS retail clients concerning GSL orders have recently come into effect.

This type of account means that the maximum potential loss for each of your positions will not exceed the initial margin amount required to open each specific position, including any overnight swap (swap fee) and other charges.

This will be linked automatically to every order that you open, whether it is a market order or a pending order.

When your position's loss reaches this amount, your position will be automatically closed by the system.

These orders allow you to protect yourself against further losses or lock in your profits when you are not able to monitor your positions.

Stop-loss orders limit your loss on a specific level. On our platform, a stop-loss order can be set based on rate, USD value, and percentage of margin.

In contrast, a take-profit order kicks in when the predefined instrument price is reached. You can set the take profit order based on rate, USD value, and percentage of margin on our platform.

Log in to your account now to start trading on instruments.

Our trading platforms

Articles in this section

Other Topics

Deposit and withdrawal

Start trading with markets.com

Getting started with markets.com

Account registration & verification

We've got you covered. Here's how to reach us for personalized help.

Book a free 1:1 training session for focused education and platform navigation to begin your journey with markets.com

We currently cannot accept clients from your country. If you have received this message in error, please contact our support team at support@markets.com.

Contact SupportOne of the benefits of trading with a regulated company is that you know you are contracting with a reliable and reputable provider in a secure environment, which has strict rules and guidelines in place, protecting the interests of retail clients. Other legal obligations of a regulated company include, but are not limited to, ensuring financial services are provided efficiently, honestly and fairly, dealing with retail client money in a certain way and having dispute resolutions systems in place in case you are unsatisfied with our services.

However, please note that regulation is not an absolute guarantee of security or reliability. Additionally, being regulated does not change that trading in CFDs and Margin FX products carries a high degree of risk, and you may lose some or all of your invested capital.

All client funds are held in segregated bank accounts, to ensure maximum funds protection. For more information, please check our Regulation & Legal pack located at the footer of our page.

The protection and safeguarding of our clients personal and financial information is of utmost importance to us, therefore we take the highest of measurements when it comes to the security of our system. You may refer to our Privacy Policy statement for more information regarding your data held with us.

Markets.com is a global company with 4.7M+ registered accounts. Unfortunately, there are certain websites and fraudsters who wish to take advantage of our brand name and seek to impersonate us.

Please refer to our Safety Online / Stay Protected Online Page for more information.

Markets.com is operated by Markets South Africa (Pty) Ltd which is a regulated by the FSCA under license no. 46860 and licensed to operate as an Over The Counter Derivatives Provider (ODP) in terms of the Financial Markets Act no.19 of 2012.

Markets.com is a global brand and trade mark used by Markets South Africa (Pty) Ltd Limited and owned by Finalto (IOM) Limited.

Markets South Africa (Pty) Ltd has the sole and exclusive use of the domain Markets.com worldwide.

We've got you covered. Here's how to reach us for personalized help.