Wednesday Nov 20 2024 02:37

4 min

Gold is firmer for a second day as the dollar retreats on slightly softer Treasury yields. Bitcoin is firming up above $91k. Estonia reckons European troops could support a Trump-led peace deal in Ukraine. The sands are shifting already. European equity markets are very mixed this morning.

Crypto: The bulls are in charge. MicroStrategy said on Monday it had bought around 51,780 Bitcoin in the last week for about $4.6bn in cash. One day, Saylor might discover he is the market.

Tesla led a bounce in tech stocks yesterday as reports surfaced that suggested – as we thought could happen – that President-elect Trump is looking to ease the regulatory path for the company’s autonomous driving software. But as we discussed last week on the podcast with Mark Spiegel from Stanphyl Capital (a long-time Tesla bear it should be said), Full Self Driving (FSD) does not work. The Nasdaq Composite rose 0.6%, and the S&P 500 rallied 0.4%, though the Dow Jones fell with some pressure on Salesforce, Goldman Sachs and UnitedHealth.

Nvidia earnings are the main event today. Piper Sandler raised its price target on the stock ahead of earnings to $175 from $140, naming the company its top large-cap pick. It cited the launch of Nvidia’s upcoming Blackwell chip and lead within artificial intelligence. Investors will be hungry for guidance on the new chips. According to Piper Sandler, Nvidia’s Blackwell chip should become available in the first quarter of next year and could bring in between $5 billion and $8 billion.

“As supply improves, we see more customers coming on for Blackwell beyond initial hyperscaler adoption in the following April quarter,” analyst Harsh Kumar wrote. “Given expanded GPU allocations and initial shipments of the Grace Blackwell for inference applications, we are projecting Blackwell architecture revenues could increase to the tune of 200%+ in the April quarter following supply constraints.”

Here is Bank of America reiterating its ‘buy’ rating: “NVDA reports on Wed with sell-side consensus for FQ3/FQ4 sales at $33.2bn/$37bn, though as usual bullish investors’ expectations likely at least a $1bn+ higher at $34bn/$38-$40bn for FQ3 and FQ4.”

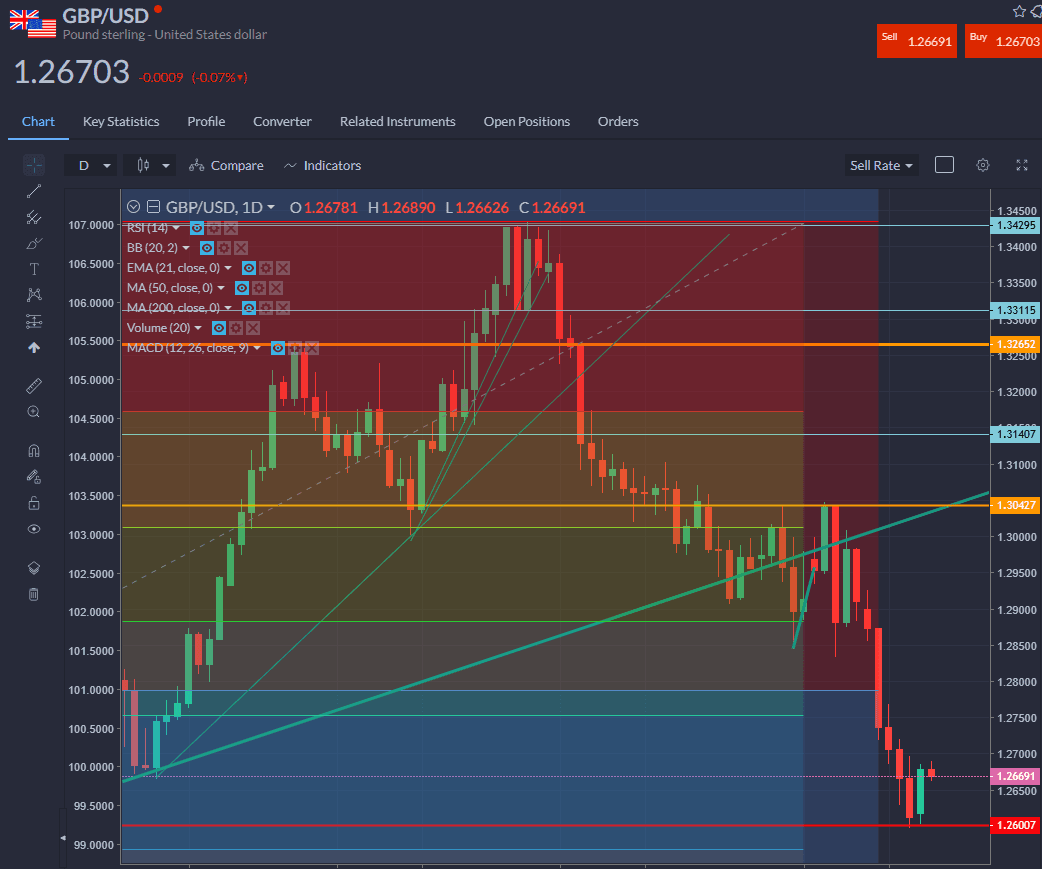

Elsewhere, GBPUSD has gained some ground after putting on a floor at 1.26, but this looks to be some giveback on the long dollar Trump trade rather than a more optimistic assessment of the UK growth outlook. Retailers are warning the Budget will hit them with £7bn in extra costs. You’d think a former economist at the Bank of England would have a better grasp of figures…

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.