Friday Jul 17 2020 12:30

3 min

Amazon (AMZN) is due to report earnings July 30th and is set for another strong quarter of revenue growth, albeit costs are also increasing. The stock has jumped more than 60% YTD – can the rally continue?

First of all, the range of estimates for the second quarter is unusually wide and is extremely hard to navigate.

Net sales are expected to be between $75.0 billion and $81.0 billion, or to grow between 18% and 28% compared with second quarter 2019. This guidance anticipates an unfavourable impact of approximately 70 basis points from foreign exchange rates.

Operating income (loss) is expected to be between $(1.5) billion and $1.5 billion, compared with $3.1 billion in second quarter 2019. This guidance assumes approximately $4.0 billion of costs related to COVID-19.

Cowen 5-star analyst John Blackledge expects Amazon to deliver another strong quarter of growth with revenue and operating income at the high end of the guided range. The key drivers will be AWS, Advertising and an acceleration in e-commerce growth, which he says will post +29% growth vs +17% in Q2 2019.

Investors should be able to shrug off upwards of $4bn in Covid-related investments flagged in the last earnings release as likely weighing on Q2 EPS numbers. As ever with this kind of growth stock, EPS can be lumpy.

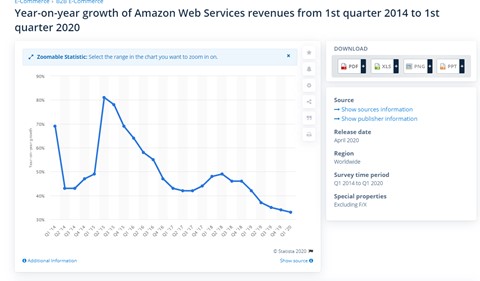

EPS will also be determined by AWS growth. Last quarter AWS revenues exceeded $10bn for the first time and whilst it generated 13.5% of total revenue, it delivered 77% of operating income. However as flagged in the past, the growth in AWS is slowing.

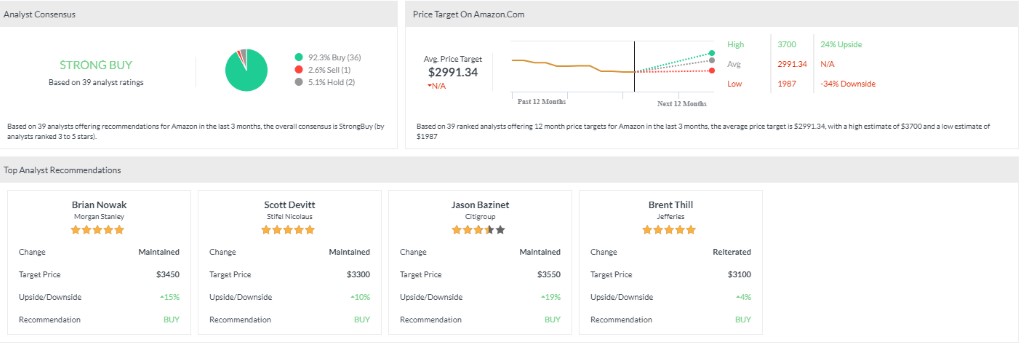

Overall analysts remain very bullish…

And hedge funds still like this stock…

MACD crossover looks bearish, whilst the recent extension beyond the 200-day moving average has historically preceded a pullback. More broadly we are starting to see signs that the Nasdaq and tech stocks are retracing some gains after the run up in the second quarter.

Asset List

View Full ListLatest

View all

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min