Wednesday Jan 25 2023 09:39

10 min

Markets a Mixed Bag

Not a lot of movement in European indices as investors still search for a bit of direction from the macroeconomic data and a slew of earnings releases on both sides of the pond. Asian stocks hit a 7-month high as some reopened after the lunar new year holiday. Wall Street was mixed as the Dow notched a third day of gains and the Nasdaq and S&P 500 dipped. A glitch at the NYSE opening auction caused 70-odd stocks to be halted for a while. Google is facing an antitrust investigation.

After a couple of strong days for Wall St on expectations the Fed is about to pause, earnings are just looking a bit wobbly. MSFT disappointed and hopes are not high for Tesla (TSLA) later tonight. Boeing (BA) releases ahead of the market open and I would see reasons to be positive after Raytheon’s Pratt & Whitney enjoyed a 127% pop in revenues thanks to strong commercial aerospace demand.

Australia Inflating; BoC Hikes to Slow

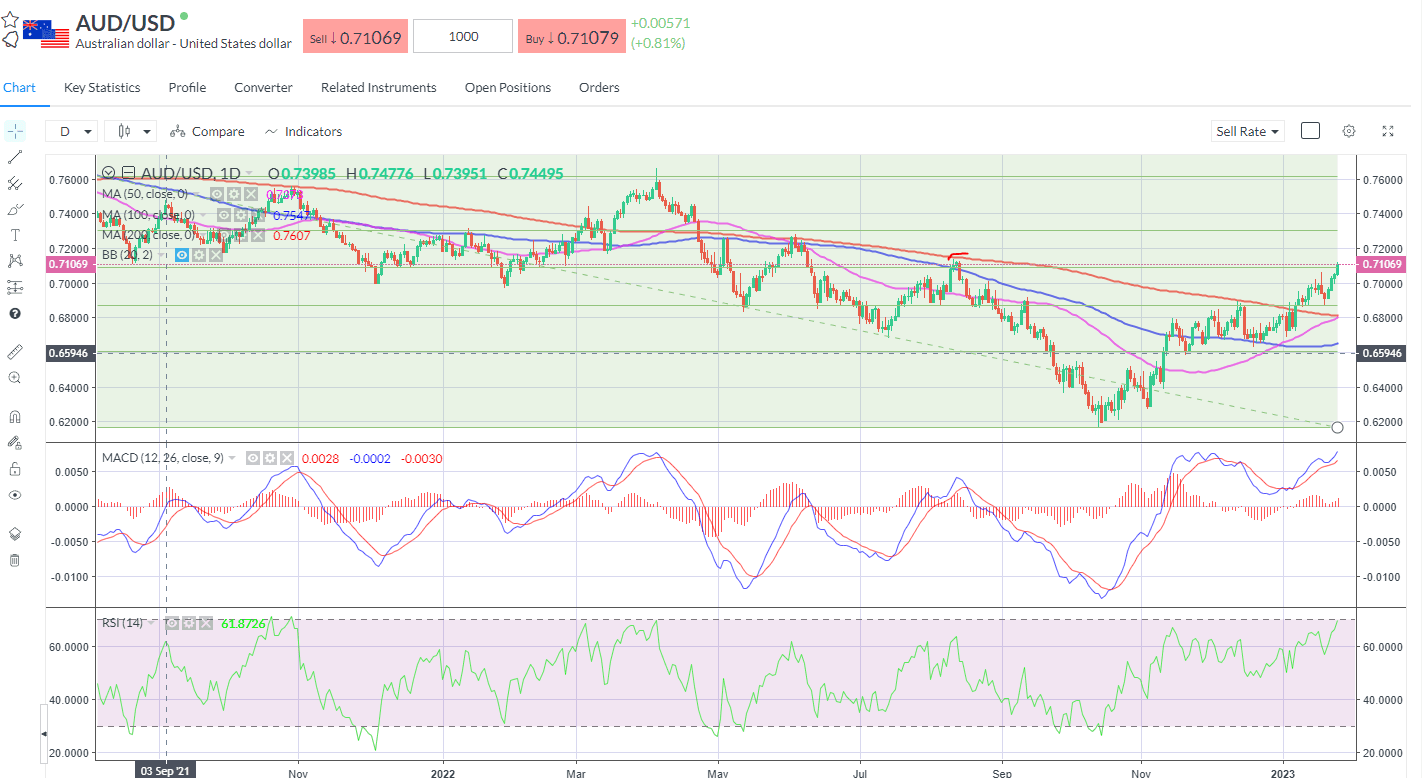

Australia’s dollar made strong headway to break out to a new 5-month high against its US counterpart after Australia’s inflation accelerated to the fastest pace in 32 years in Q4 2022. CPI rose 7.8% year-on-year vs the forecast 7.6%. This latest rise in inflation puts more pressure on the RBA to hike interest rates further – another 25bps hike in Feb looks assured now. It hiked rates by a combined 300bps last year and markets expect one or two more 25bps this year before peaking. Rising inflation might force a reset in market pricing for the terminal rate. Currently the market expects a 25bps in February to take the cash rate to 3.35%, with one more later in the year to hit 3.6%. China reopening is surely inflationary.

Bank of Canada to hit terminal velocity? The BoC is expected to call it a day – for now – after a final 25bps hike later on today. Slowing economic activity and inflation is regarded as an opportunity to pause for reflection – after a breakneck pace it’s time to check the rear view mirror for the damage.

PMI at Odds Across the Pond

Sterling was off to a week low as a soft PMI and jump in borrowing knocked sentiment yesterday – UK economy showing weakness and this left sterling on the back foot handing back its gains since the middle of last week, with GBPUSD taking a 1.22 handle again, with a low of 1.2260 pared back to 1.2325 area this morning. Both the Composite and Services PMIs fell to 24-month lows. Some better news on UK inflation this morning with producer prices slipping. Input prices rose by 16.5% in the year to December 2022, down from 18.0% in the year to November 2022; whilst factory gate prices rose by 14.7% in the year to December 2022, down from 16.2% in the year to November 2022.

US – stronger PMI helped lift the dollar as the flash composite PMI recorded a three-month high. Whilst these surveys are often not a lot of use, I think it’s really worth starting to look at these diffusion indices again as we enter a period of uncertainty about the economic outlook and the impact – and future path – of rate hikes.

Markets Pray for Doves

Traders are betting on a dovish Fed – hearing more and more ‘one and done’ 25bps calls...beware. I just think the market is being way too optimistic.

Meanwhile an ex-BoJ official reckons the central bank will phase out extraordinary measures this autumn. The Summary of Opinions, which precedes the more detailed minutes by some time, from its last meeting is due tonight – could give further clues on thinking about the off-ramp from YCC and NIRP…Japanese 10yr yields drifting higher to 0.445% again. USDJPY holds around 130.

Earnings

Strong update from EasyJet sending airline stocks higher this morning as it reported strong growth in for summer 2023 and a return to profits. EZY said it expects to beat profit expectations, citing strong booking and pricing trends. For the first quarter it reported revenue per seat growth of 36% year on year, as well as ancillary revenue of £20.12 per seat, also +36% year on year. Moving into to its second quarter it anticipates continued strong yield and load factor – and ancillary revenue - growth. It looks like consumers are continuing to prioritise holiday spending – a post-pandemic hangover that is good news for airlines. EZY rose 9%, with IAG +2% and Wizz +5% on the read across.

Ascential +23% after announcing plans to split the portfolio. It will pursue a US listing for its Digital Commerce business, sell WGSN and keep the events biz as Ascential plc. Not the only FTSE 250 company where the sum of its parts were/are worth more than the whole. Numbers also looking good with double-digit revenue growth across all four segments

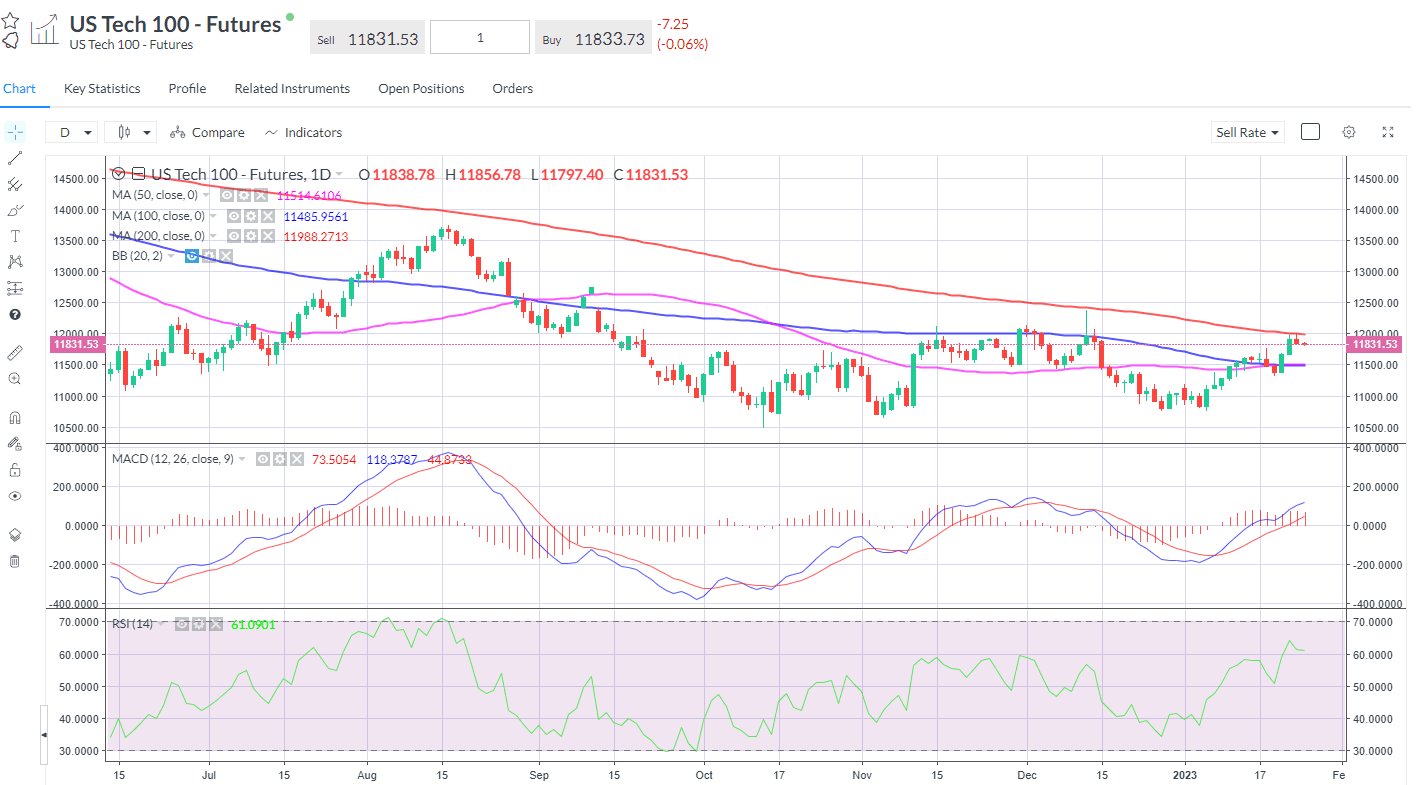

Microsoft (MSFT) was downbeat as revenue growth decelerated to a 6-year low. Shares fell in the after-hours market following the earnings release, which suggests the outlook for the broader tech sector remains soft. CFO Amy Hood said a slowdown across commercial lines seen in December would continue into 2023. Decelerating growth in the cloud business and corporate software is hardly a surprise, but investors will be keen to see how this plays out longer term and how quickly it can bounce back or whether this is the ‘new normal’.

3M (MMM) expects challenges in the year ahead, sees organic growth flat at best in a range of –3% to 0%, total sales seen at –2% to –6%. The company saw rapid declines in consumer facing markets in the fourth quarter. Shares declined 6%. Bellwether stock.

Raytheon, Lockheed Martin, Halliburton all beating and reaping rewards from the global macro backdrop – rising demand for air travel, higher refining margins and tight crude market, the war in Ukraine, etc. Some good numbers in there and we note read across to defence stocks in Europe this morning on reports the US and Germany will send their Abrams and Leopard tanks to Ukraine.

Semis – Bernstein downgraded AMD to perform from outperform (hold from buy) and calls for fiscal year decline for iPhone demand. Citi sees artificial intelligence ChatGPT as a $5 billion to $11 billion opportunity for Nvidia after MSFT just invested billions.

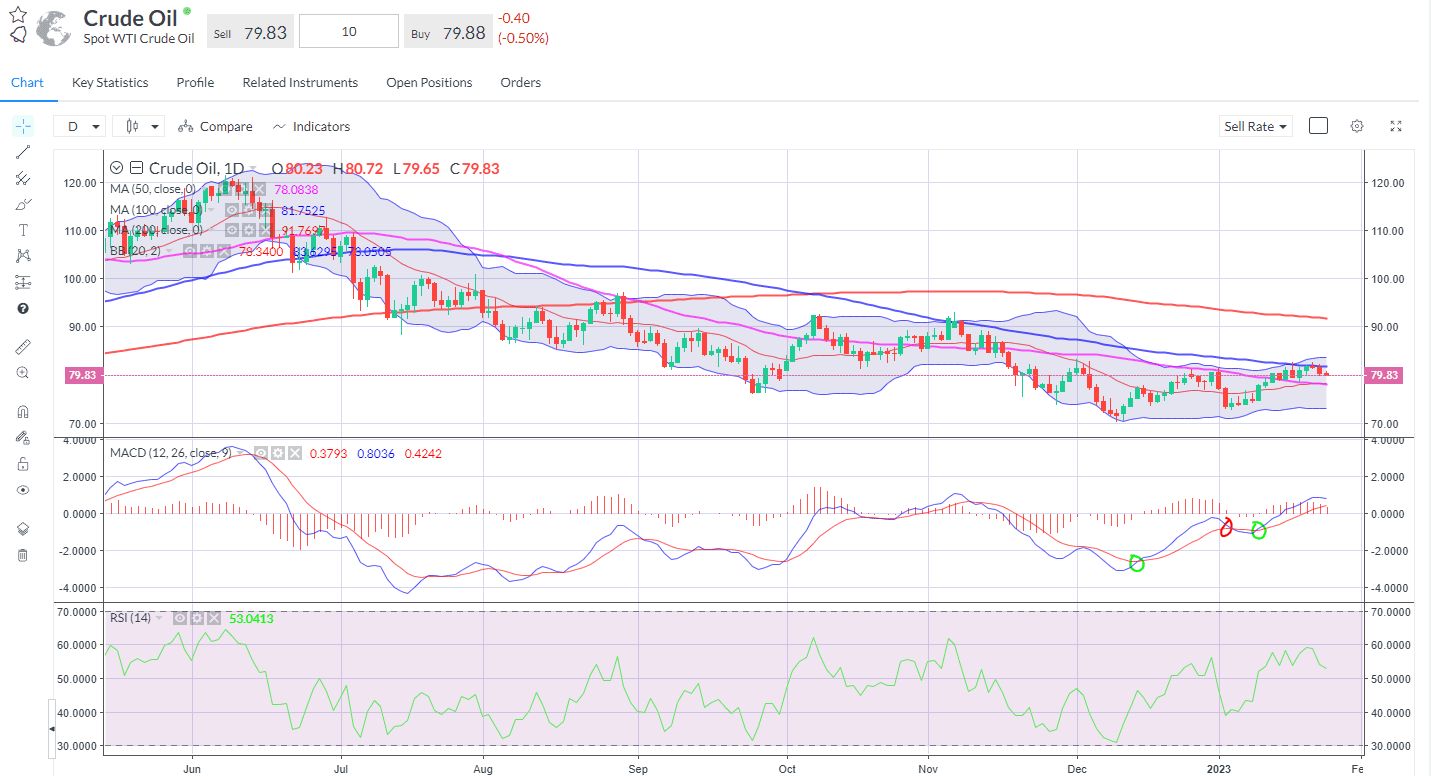

Oil and inflation – China doing all the lifting as the market moves back into its more normal state of backwardation. Open interest also healthier. Meanwhile WTI’s ‘3-2-1 crack spread’ touched a three-month high of $42 a barrel... all of which is hardly bullish in terms of inflation pressures. Combined with broader and stickier services inflation, a reassertion of commodity/energy inflation would give central banks a major headache.

In the Charts

With a move north of 71, AUDUSD cleared last week’s high and breached the 50% retracement at 70.880, eyeing a breach of the August highs at 0.7125-36. Bulls looking for this to catalyse a return to the 61.8% at 73.

Futures have the S&P 500 just under 4,000 this morning, still clear of the year-long trend; NDX pulled back after touching the 200-day line.

Crude oil continues to pull back from the 100-day line resistance. A possible retest of the 50day could see a bounce.