Monday Oct 12 2020 08:40

6 min

The Bank of England is laying the groundwork for a descent into negative interest rates. This should worry us all. In a letter to banks today, deputy governor Sam Woods asked firms to detail their “current readiness to deal with a zero Bank Rate, a negative Bank Rate, or a tiered system of reserves remuneration – and the steps that you would need to take to prepare for the implementation of these”.

The letter notes that “the financial sector … would need to be operationally ready to implement it in a way that does not adversely affect the safety and soundness of firms”, and explains that “the MPC may see fit to choose various options based on the situation at the time”.

It comes after details from the last policy meeting showed that the BoE is actively considering negative rates, whilst Andrew Bailey has been at pains to stress that this does not necessarily mean they will take that route.

Indeed there is clearly a debate within the MPC going on right now that we are seeing play out in public. Last month deputy governor Dave Ramsden issued a note of caution only a day after Silvana Tenreyro pointedly backed negative rates.

It looks as though there are some clear ideological disputes among rate setters that needs to be worked out over the autumn, implying as Andrew Bailey suggested last week that negative rates are not likely on the near horizon, albeit they are being considered actively.

The problem for the Bank would be an unemployment crisis into Christmas that could put pressure on the MPC to act.

Sterling doesn’t mind too much, with GBPUSD making its highest in almost 5 weeks before paring gains a little. Bank shares also didn’t take fright, with Natwest and Lloyds higher at the open.

Money markets have already priced in negative rates next year – today’s update does not materially alter the perception that the Bank is thinking seriously about negative rates but is in no rush to wheel them out. US bond and money markets are closed today for the Columbus Day holiday.

The idea that negative rates boost lending doesn’t wash – banks are not worried about the marginal impact on net interest margins as they are about whether the principal is repaid or not. And this in the current economic downturn and threat of rising unemployment, this will weigh on banks’ willingness to lend.

Indeed, I refer you again to the San Francisco Fed study from last month that shows the ECB made a big mistake by going negative.

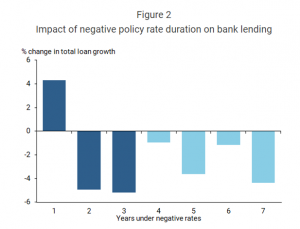

This noted “banks expand lending only temporarily under negative rates” and “as negative rates persist, they drag on bank profitability even more”. It concluded that while lending initially increases under negative rates. “…gains are more than reversed as negative rates persist”. And under extended periods of negative rates, the evidence shows that “both bank profitability and bank lending activity decline”.

Negative rates are meant to increase loan growth, not depress it.

Equities were mildly higher in European trade early on Monday. The FTSE 100 enjoyed a solid week and managed to close on Friday above the 6,000 level that has proved so tricky to hold onto.

The FTSE weakened a little in early trade back to this round number support, with energy and consumer cyclicals dragging.

The S&P 500 rose Friday and closed at its best level since the start of September when it made the all-time high. Stimulus hopes remain in the forefront but the market, as a result, remains on the hook to rumours and headlines.

Donald Trump upped his offer to $1.8tn but Nancy Pelosi said it wasn’t enough. A stimulus package is coming sooner or later, although as stressed last week, there is a risk that a disputed election result delays this until 2021.

On the slate this week: IMF and World Bank meetings kick off today, whilst we have three days until the UK’s self-imposed Brexit deadline.

Nevertheless, even if there no breakthrough comprehensive trade deal agreed this week, the two sides are pledged to continue talking right up to the last moment.

Emmanuel Macron, who faces elections in the not-too-distant future, may seek too many concessions over fishing rights, which may scupper a deal. However, with the coronavirus causing havoc with the economy, neither side has a particularly strong hand and both sides need a deal.

Wall Street banks kick off earnings season across pond – read our preview here.

Biden leads by 9.8pts nationally and by 4.5pts in the battlegrounds. The Democrats lead by 4.9pts in the battleground states four years ago – Trump has been over this ground before and won against the odds – don’t write him off just yet. Trump has pulled ads in Ohio and Iowa leaving him off air in those states for a third week in a row. According to our friends over at BlondeMoney are the two most winnable swing states for Trump.

They say: “Either Trump is supremely confident he’s got these in the bag, despite polling neck-and-neck with Biden. Or he realises that he’s got to double down and go for the tougher states, and hope to sweep up those that are easier to win in the process. If he doesn’t get Florida or Wisconsin, Ohio or Iowa barely matter.”

My sense is that there is do-or-die attitude in the White House and he needs to shore up support elsewhere, such as Florida as his campaign finances, rather like his business empire, are not all they appear to be.

The dollar appeared to roll over last week. On DXY we had a MACD bearish crossover and 14-day RSI trendline break that indicated (as we flagged) that there could be downside.

What’s harder to say is whether this is yet more of a chop sideways for the dollar or renewal of the downtrend.

The close under the 50-day SMA could be taken as bearish signal and we may yet see the 91 handle tested again. The near-term support at the mid-Sep swing low sits around 92.70.

Asset List

View Full ListLatest

View all

Wednesday, 2 April 2025

4 min

Tuesday, 1 April 2025

6 min

Monday, 31 March 2025

5 min