Thursday Jul 11 2024 11:19

5 min

Will the Bank of England cut interest rates in August? Not so fast, say a couple of policymakers.

A sharp decline in inflation has set up a potential rate cut from the Bank of England this summer. CPI inflation declined to a rate of 2.0% in May, figures released in June showed. But market expectations for a rate cut in August, when the Bank of England next meets, may be wide of the mark. Last Monday MPC member Jonathan Haskel said he “would rather hold rates” until there were further signs of cooler inflation.

Now Huw Pill, the Bank of England’s chief economist, has also chimed in with comments that seem to suggest the MPC is leaning towards holding interest rates steady next month. Speaking yesterday, he pointed to the “persistence” of underlying inflation, noting that services inflation and wage growth remain close to 6%. He also noted “some upside risk” to his assessment of this persistence.

It probably makes next week’s CPI report make or break for an August cut. Markets trimmed bets from around a two-thirds likelihood of a cut next month to 50/50 after Pill’s remarks.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Meanwhile Britain’s key service sector (number two exporter after the US) rebounded nicely in May to help push UK GDP growth to 0.4%, twice the rate expected. It hints at the existence of tailwinds for the UK economy just as the government takes office – a bit of luck on the side of Labour Party.

Construction rebounded 1.9%, growing at its fastest rate in a year – this was before the UK general election. If only Sunak had given it a bit more time? We will never know. It’s a sign that the UK economy was turning around before Labour got in and well before any reforms the new government carries out take effect. I am sure they will be keen to stress that.

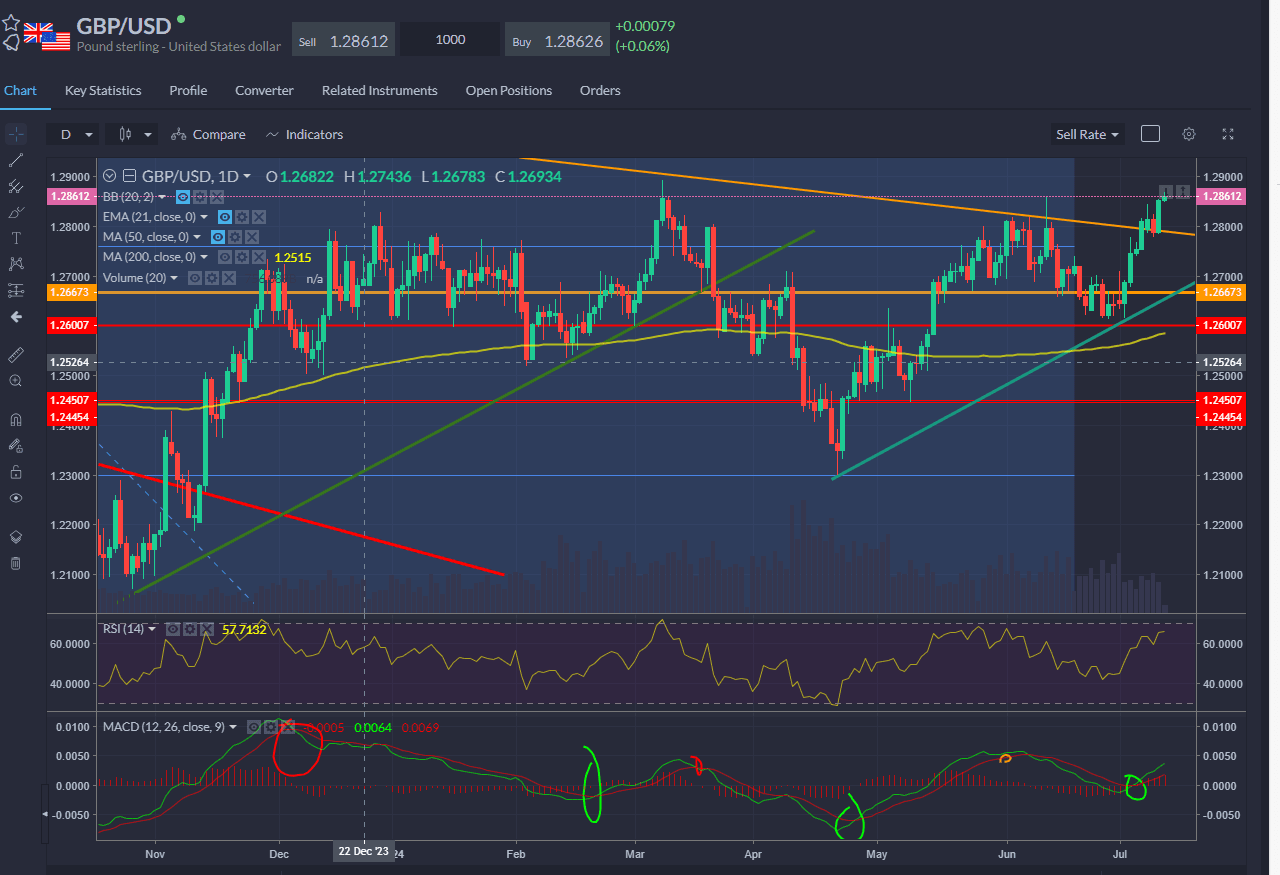

The comments from Bank of England policymakers and the data helped lift sterling to extend the run higher for GBPUSD north of 1.2860, its best in four months. Bulls, with momentum from the bullish MACD crossover still, looking now to breach the March swing high resistance and clear 1.29.

Thoughts of an August interest rate cut could keep this in check, though we should also bear in mind US inflation today will have a bearing on the outlook for the Fed rate path.

Elsewhere, Joe Biden is facing mounting calls to stand down – even Dr. Doug Ross from ER says so. We talk about the thorny topic for Democrats in this week’s episode of the Overleveraged podcast.

Asian shares rallied, led by strong revenues from chipmaker TSMC. Japan's Nikkei 225 index hit a fresh record high. European stocks were timidly higher at the open. The S&P 500 rallied a full 1% to close above 5,600 for the first time.

US CPI inflation data is coming today. CPI was flat month-on-month in May, up 3.3% for the year. Core CPI increased 0.2% on the month and 3.4% from a year ago, which was a slower pace than expected. Following this report, May’s core PCE inflation data – the Fed’s preferred gauge – also came in cooler than expected at just +0.1% MoM, further adding to the sense that the series of hot inflation reports earlier this year are now firmly behind us. The data today is expected to show core +0.2% MoM, headline +0.1% MoM for a reading of +3.1% YoY.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Wednesday, 2 April 2025

4 min

Tuesday, 1 April 2025

6 min

Monday, 31 March 2025

5 min