Wednesday Oct 18 2023 10:14

7 min

Oil up, gold up as Biden heads to Israel amid escalation fears following a rocket strike on a hospital in Gaza. Why would Israel strike it? Cui bono? Certainly not Israel…but then there is the USS Liberty incident… The propaganda war is key and Hamas knows this...but I ain’t no geopolitical expert and am entering dangerous territory. The key is: we don’t know how this plays out but you think maybe the tail risks for escalation just got fatter. Planned meetings between Biden and Arab leaders are off … airline shares down – all we need now is a flare up in the Balkans to really hit global travel. US says not to travel to Lebanon.

Oil maybe hasn’t gone up as much as it might have although it jumped to its highest in two weeks this morning with Brent above $92 – we’re not very good at pricing geopolitical risks and tails. And shipping costs are going up a lot in the Med ...supply chain costs rising which means more inflation! We are in a new paradigm where the default is to go higher. War is inflationary.

Finally, gold rallied to a 4-week high despite the rise in yields and support for USD – clear haven bid there it seems. Stocks were mixed at the open in Europe on Wednesday as we continue to chop around in the fog of war. Russell 2k rose more than 1%, the Nasdaq fell a quarter of a percent and the S&P 500 was flat. UK inflation this morning was above expectations at 6.7% - will keep the Bank of England honest. Cable trades flat around 1.2180.

And now chips – Biden is restricting chip sales to China, producing a sharp selloff in the likes of NVDA, AMD etc, and this again is not in the vein of lowering inflation. Nothing to see here: On July 27th, Nancy & Paul Pelosi offloaded their entire 25,000 Nvidia shares. Despite this, overnight China data better than expected with Q3 GDP +4.9% yoy and retail sales +5.5%...always taken with a pinch of salt. Meanwhile the BoJ carried out another unscheduled bond buying operation after the 10yr hit a fresh decade high at 0.815%...USDJPY itching for a pump to 150 again to test the BoJ and MoF.

We live in interesting times: More than 20,000 people in the UK have been approached covertly online by Chinese spies, according to the head of MI5, who says thousands of British firms are at risk of having their innovation and IP stolen. Shocking I know.

Yields up with the US 10yr coming within a whisker of its 16-year high again above 4.88%. US retail sales +0.7% vs +0.3% expected, control group +0.6% vs expected flat reading – remarkable resilience = higher for longer, which is why the long end moved. Liquidity concerns around the Treasury market also rearing up again. Homebuilder sentiment drops to 10-month low, as mortgage rates soar.

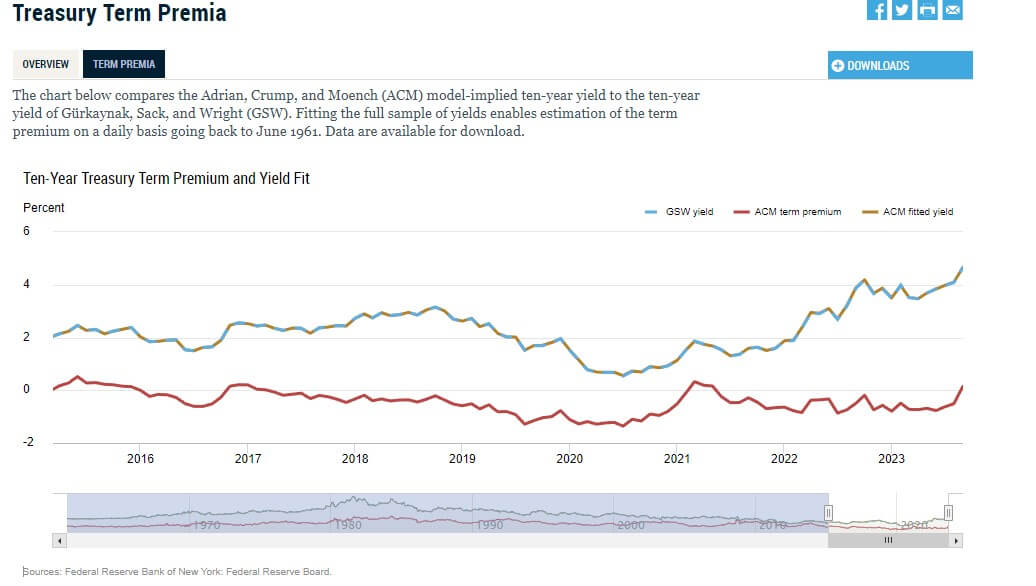

Federal Reserve Bank of New York’s gauge of the 10-year term premium turned positive lately and is shooting higher still. It’s a sign that investors want more return for holding duration and points to the long-end staying higher for longer.

Remember all those unrealized losses on banks’ balance sheets? BofA: “Because we're holding them to maturity, we will anticipate that we'll have zero losses over time.” Aha so that in a nutshell is why we shouldn’t* worry about the big banks sitting on huge unrealized losses on their bond portfolios. These are paper losses, and unless you sell before maturity you don’t take a loss. The bank reported unrealized losses of $131.6 billion on securities held until maturity in the third quarter, growing from nearly $106 billion in the second quarter.

I guess the easy answer is yes and no. Declines in the value of a bank’s securities portfolio “may pose consequences for banks and borrowers alike”, says W. Blake Marsh and Brendan Laliberte in a Kansas City Fed paper from earlier this year as investors digested the banking crisis.

“In some cases, declines in the valuation of securities holdings in response to interest rate changes mechanically reduce key regulatory capital and liquidity ratios. Further, should banks need to sell the securities to generate income when their valuations are low, the unrealized losses will become realized losses, eroding capital buffers and possibly threatening the solvency of the bank. Lower capital can reduce the willingness of banks to lend, as solvency concerns increase debt and equity costs. Ultimately, lower securities valuations can increase loan prices and reduce loan growth.”

The problem is probably one of profitability more than solvency. Having a massive stack of low yield assets hampers the bank’s ability to put money to work to generate higher returns. Silicon Valley Bank had a tonne of unrealised losses but it was more about a bank run than due to mark-to-market losses on the books.

The Kansas City Fed paper notes these unrealised losses dampen loan growth through four channels:

“First, unrealized losses can increase equity costs as investors’ perceptions of financial health deteriorate. Second, deterioration of financial strength combined with increased liquidity needs can increase debt funding costs. These increased equity and debt funding costs are likely to be passed on to borrowers as higher interest rates, potentially reducing loan demand. Third, unrealized losses can also make banks more reluctant to sell securities, creating liquidity demand that could limit future loan supply. Lower loan demand due to higher prices and lower loan supply due to higher funding costs could reduce total loan growth. Fourth, unrealized losses can dampen merger and acquisition (M&A) activity because potential buyers may be reluctant to purchase a bank holding securities in a deep loss position. Reduced M&A activity can result in a less effective banking system to the extent that it allows inefficiently run banks to continue operating. In this way, a slowdown in M&A activity can result in poorly allocated, or reduced, aggregate lending.”

Nevertheless, BofA net income rose 10% in the third quarter to $7.8 billion. Investment banking fees rose 2% to $1.2bn, defying an industry-wide decline. Sales and trading revenue +8% to $4.4bn to its highest in more than a decade. Net interest income (NII) rose 4% to $14.4 billion. Shares rose more than 2% but are down 17% YTD. Even if the earnings are good investors are not so keen on all those unrealised losses after all…

Asset List

View Full ListLatest

View all

Monday, 7 April 2025

4 min

Sunday, 6 April 2025

6 min

Sunday, 6 April 2025

5 min