Thursday Feb 8 2024 11:08

6 min

Strong earnings data continued to power Wall Street, with tech leading gains once again. The S&P 500 rallied four-fifths of a per cent to a whisker below 5,000. There were more gains for the Mag 7 and Arm Holdings got in on the action after-hours following its earnings report.

Arm rallied 20% after earnings pointed to the AI opportunity for the British chip designer. Disney also rose after it beat earnings estimates, raised guidance for the year and reported progress on streaming losses.

Gains were seen for Ford and Chipotle as well. New York Community Bancorp ended the day up 6% after appointing a new chairman. - still, there are worries about contagion from commercial real estate exposure.

European shares struggled a bit to take the cue from the rise on Wall Street and jump in Asia, led by a 2% rally for Tokyo, to broadly trade flat in the early part of the session, reflective of the general lack of direction this week that has left London, Paris and Frankfurt barely changed. The Nasdaq Composite is up more than 2.5% for the week, in contrast.

Slew of corporate updates in London this morning. Unilever sales missed expectations, which they say were ‘disappointing’. Market share wins were down, turnover was down, underlying sales growth up just 7%.

However, margins are healthier, with underlying operating margin up 60bps to 16.7%, with gross margin up 200bps for the year and up 330bps in the second half. That and a new €1.5 billion share buyback to commence in Q2 helped to lift shares by 3% in early trading.

Just a word on goods inflation - underlying price growth decelerated from 10.7% in the first quarter to 2.8% in the fourth quarter, reflecting lower net material inflation in the second half… goods deflation has been a factor in lowering CPI through 2023. Can it continue?

Elsewhere, Chinese deflation hit a 15-year high with the CPI –0.8% in the year to January, whilst PPI was –2.5%, falling for a 16th straight month — China as the new Japan.

British American Tobacco stock rose more than 6% as it delivered a healthy look the new business lines. Management reported strong volume led New Category revenue growth — driven by Vuse and Velo, with revenue from non-combustibles now accounting for 16.5% of group revenue. Also of note, New Categories achieved profitability in 2023, which is two years ahead of the company’s original target and contributed almost £400 million increase to group profit. BATS and ULVR added more than 20pts to the FTSE 100 index, but AZN and oil majors scrubbed them off.

Weekly unemployment claims report today seen at +221k. Beware a bit of the nonfarm payrolls report in the background – there is always a lot of noise in the January figures. Here is NSA showing 2m+ decline in jobs, though of course the trend is still positive longer term, and these blips are standard at this time of year. It’s not to say that the jobs market is collapsing, just to take the BLS numbers with a pinch of salt. Also to watch today are several speakers from the Federal Reserve.

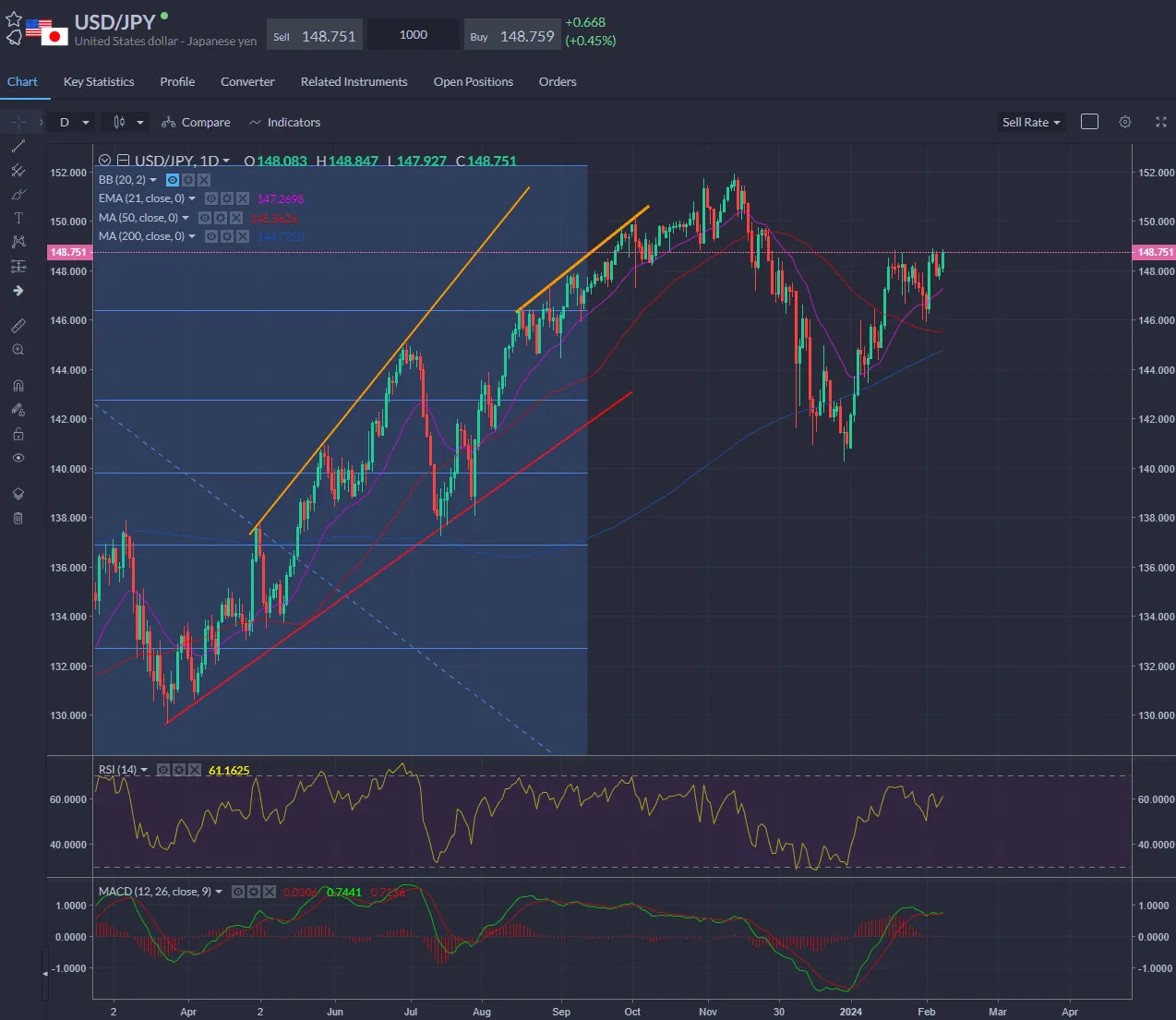

USD/JPY was flirting with its highest since November as the Bank of Japan put pressure on the yen by saying it would not raise rates quickly. Deputy governor Uchida said the central bank would likely end buying risk assets but avoid a rapid hiking cycle.

The comments were the clearest signal yet as to the pace and timing of the BoJ’s exit from ultra-loose monetary policy. It suggests they are close to pulling the BoJ out of negative rates but refrain from moving too aggressively thereafter.

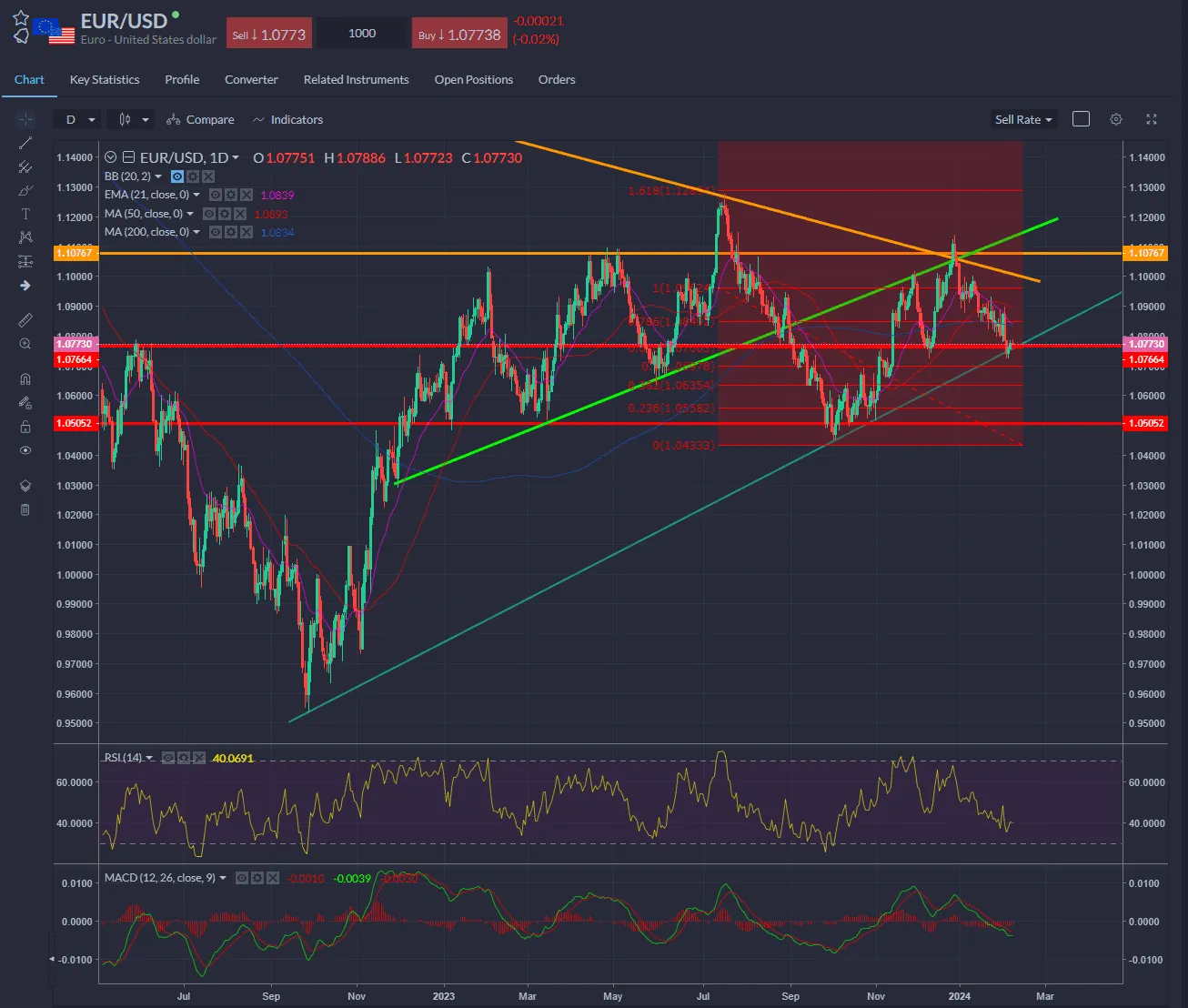

EUR/USD also rose to its best in a week but dragged back down to the long-term trend line for good measure.

When considering shares and indices for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.