Wednesday Feb 1 2023 09:37

7 min

Fed Raises Rates, Market Braces for Volatility

Ain’t nothing but the Fed today as investors focus on the FOMC interest rate decision. The Fed is all but certain to raise rates by 25bps but the complacency we see sets up for a volatility-driven event if Powell pushes back hard – and why not? There is no reason for the Fed to signal a pause – financial conditions have loosened considerably, inflation remains high, the labour market tight and commodity-linked inflation could be rearing its head again. However, as we have seen countless times, the market is willing to take a dovish read to just about anything the Fed says. Full FOMC preview.

The sharp moves of the last two days on Wall Street indicate we are in the kind of market that will chop both bulls and bears, with the S&P 50 jumping almost 1.5% yesterday after a similar move to the downside on Monday. BNP Paribas says the decline in volatility has pumped systematic buying flows that have driven the rally – worth considering that stocks are up not because ‘investors’ are turning decidedly more bullish of late but the decline in volatility (VIX still sub-20) has triggered algos to buy...what happens when the volatility returns?

Rally on the Table – Held Back by Uncertainty

On Wall Street Dow closed up 1.1% at 34,086, the Nasdaq Composite added 1.7% to 11,585 and the S&P 500 rose 1.46% to 4,077. Whilst we have seen the market rally strongly in January – the S&P 500 +6.2%, the Nasdaq +10.7%, the indices are yet to break above the Nov/Dec peaks. Breadth is there but conviction seems to be lacking and the market is now a lot less cheap than it was a month ago and earnings are about to become a headwind. Still see the ‘oversold’ speculative tech doing well with ARKK up 31% this year, with Tesla up another 4% to leave it up 60% YTD in what has been a staggering rally for the stock over the last month.

We are seeing a sideways chop in Europe too, with the FTSE 100 rejecting 7,700 yesterday to trade up towards 7,800 today; but it broadly remains within the range of the last fortnight as investors search for more direction. Continued drift higher from the lows last week could see the FTSE take a look at the Jan 23rd high at 7,811.

Economic Data & Corporate Earnings Today

China Caixin Manufacturing PMI contracted for the sixth month in a row, declining to 49.2. EU inflation due at 10am GMT, seen at 9.0% from 9.2% prior, with core declining to 5.1% from 5.2%. US ADP employment data ahead of Friday’s nonfarm payrolls plus we have the JOLTS job openings and ISM manufacturing PMI to look forward to.

Earnings aplenty on Wall Street. Caterpillar – solid quarter being treated badly due to bottom line miss – unfavourable currency impacts and ongoing inflation pressures weighing on margins. General Motors – big beat, guiding strong on adjusted EPS, not going to match Tesla on price cuts. AMD beat expectations but guided for a 10% decline in sales in the current quarter.

Oh Snap (chat)!

Tough read for the social media space (META, PINS) - shares plunged almost 15% in the after-hours market after it warned revenues could decline by as much as 10% in the first quarter of 2023. Still updating ad model following the iOS update. Revenues in the prior quarter were steady at $1.3bn, the slowest pace of growth since 2017. Meta Platforms reports this evening after the closing bell and it could be tough – EPS seen –40% at $2.20 and net income –43%. Expect a continued hit from shrinking advertising revenue and higher costs.

FX & Oil Markets Updates

In FX, USDJPY continues to sit at 130, EURUSD is firmer towards 1.0890 and GBPUSD has held steady above 1.23 this morning after taking a 1.22 handle at one stage yesterday. Lots of sideways chop until the Fed and BoE/ECB shake out today and tomorrow. Watch for significant moves around the meetings, particularly in GBPUSD, EURUSD and EURGBP.

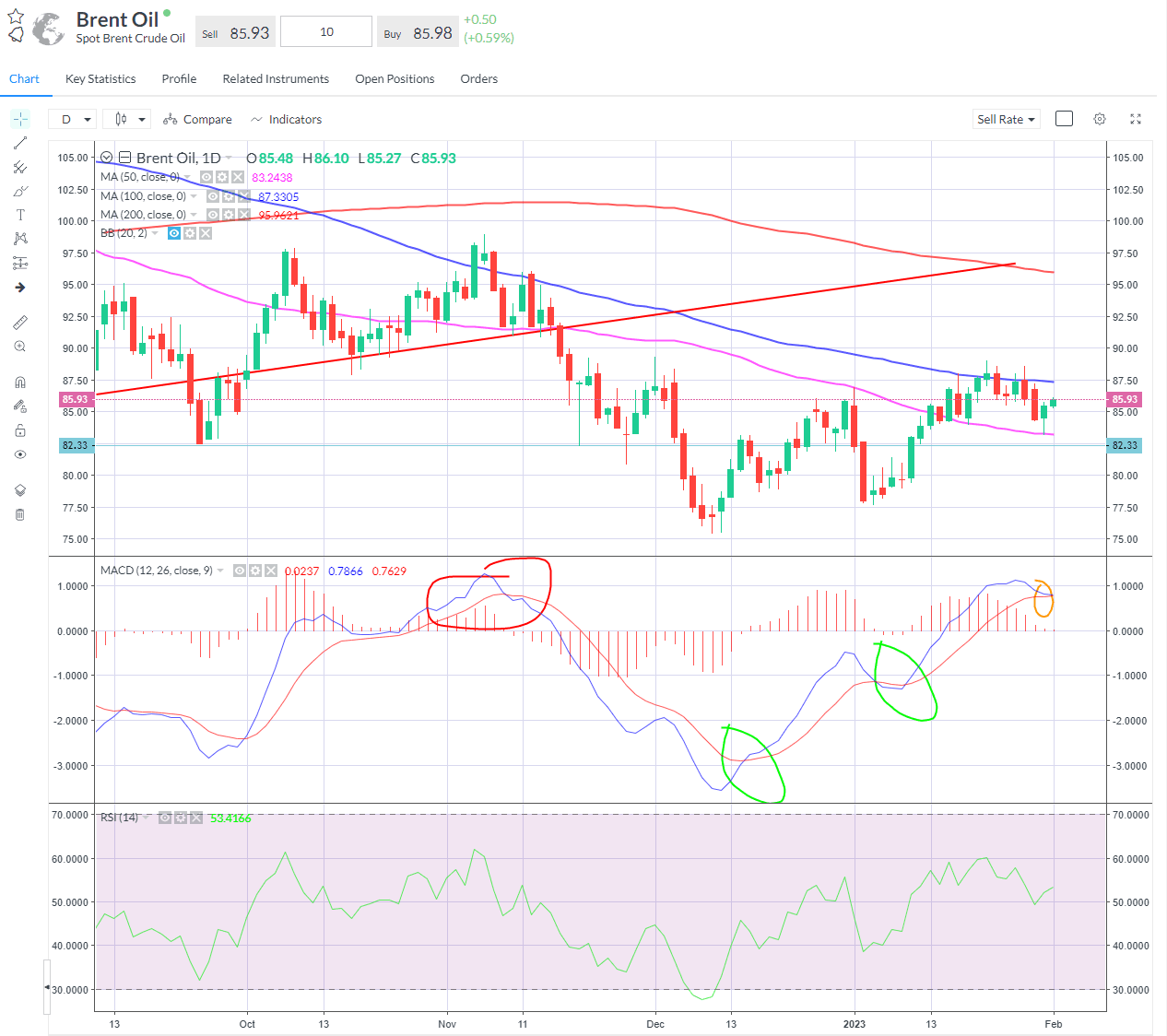

Brent – bounced neatly off the 50-day line, MACD not quite crossing. WTI traded clean through the 50-day but also bounced back sharply.