Friday Feb 16 2024 13:21

7 min

Labour dealt a hefty blow to the Sunak regime by taking two by-elections in previously safe Conservative seats, overturning majorities with pretty monster swings of 28.6% and 16%. We talked about the importance of these results in our latest edition of Overleveraged, our new podcast series.

Labour was strong but the Tories didn’t totally implode – it could be tighter than we think. And that will have implications for investors. When can we shake off the British discount? Is that now a forlorn hope?

The S&P 500 index closed at a fresh record high, and the Nasdaq and Dow Jones also rose Thursday. Retail sales dropped 0.8%, more than expected – bad news was good news and the major indices have repaired the damage from Tuesday’s inflation-linked decline.

Tokyo rose again overnight, with the Topix rallying more than 1% and Nikkei index +0.8% for a fresh multi-decade high – it's now only 1% off its all-time high set in 1989.

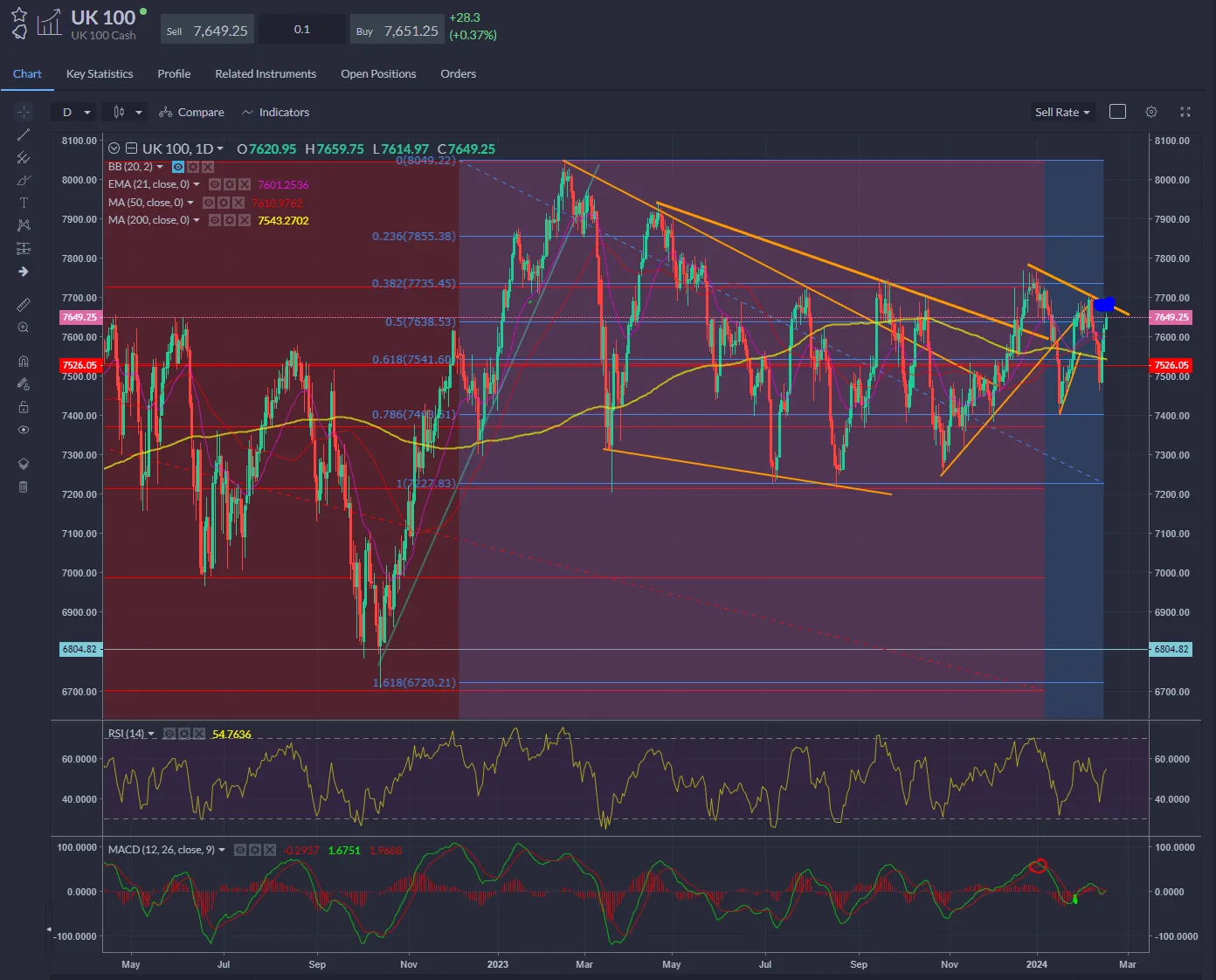

European stock markets rallied on Friday after the positive moves elsewhere. The FTSE 100 climbed 0.7% to 7,660, still in its sideways funk really but more upbeat and less staring at its trainers today as miners rose.

There were similar gains for the DAX and CAC, which rose by around 0.6% in early trade to both touch intra-day record highs. Maybe the ECB is moving closer to a cut?

For now, London is missing out – a strong new government voted in on a platform for delivering strong economic growth might be helpful… don’t hold your breath. In this chart we can see the 200-day line breach was rejected this week and bulls look to see if we can break north of this area, around the 7,700 resistance.

One I omitted to mention yesterday was billionaire investor Stan Druckenmiller sold shares of Alphabet, Amazon, and Broadcom while buying shares of gold miners Barrick Gold and Newmont, according to a filing with the Securities and Exchange Commission.

Meanwhile, Bezos dumped yet more Amazon shares – another $2bn worth that takes the total to $6bn in the last week.

Apple H&S pattern with price continuing to test the 200-day SMA.

There was a massive pump at the death yesterday to avoid closing below the 200-day line.

Elsewhere, cable tests its 200-day line also with the dollar coming off a bit in the last two sessions following the CPI-induced ramp, whilst the 10-year Treasury remains just a bit under 4.3%, a little way off the Tuesday high.

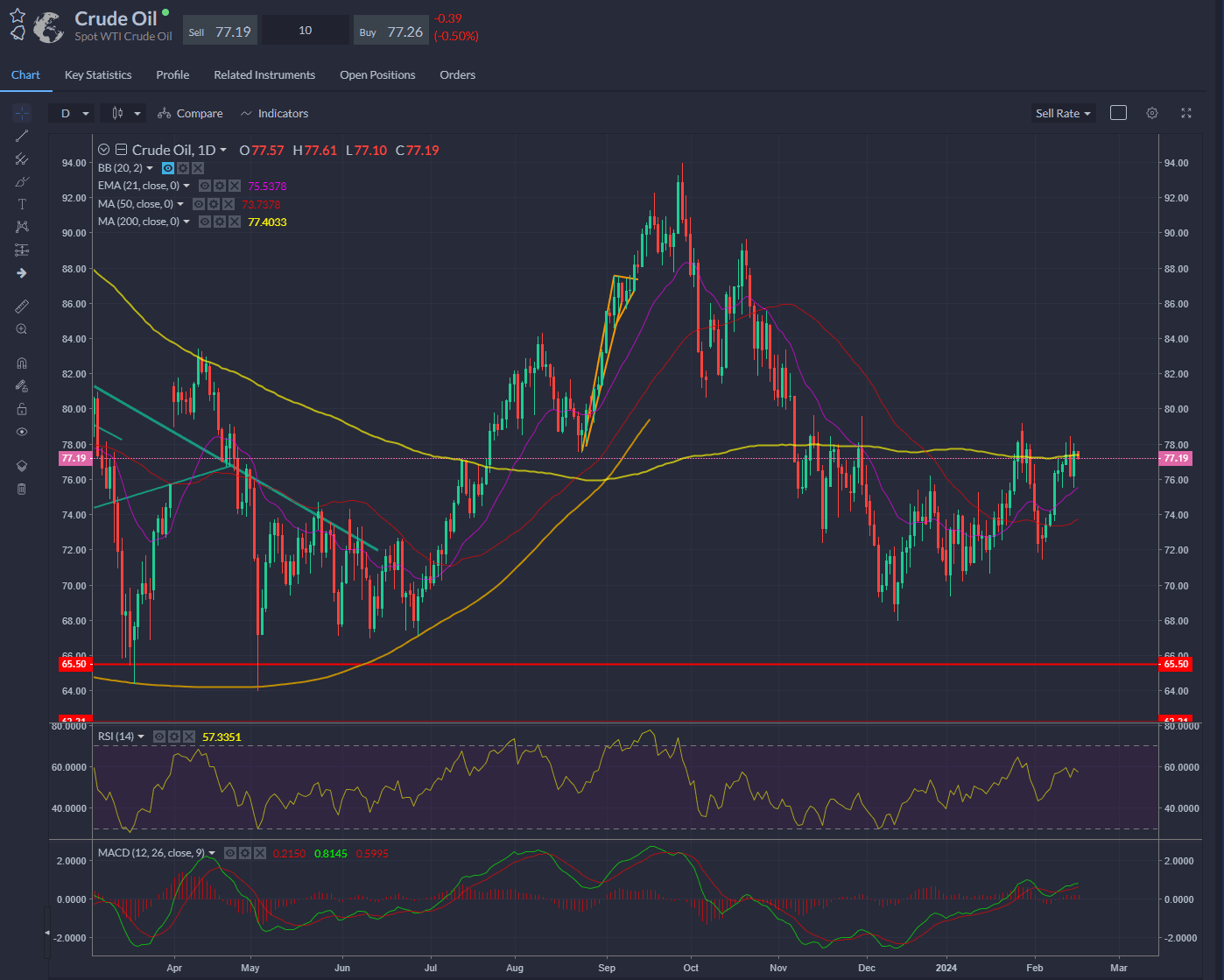

Another to test the 200-day is crude oil, which has lacked any meaningful direction this week.

When considering shares, indices, bonds, and foreign exchange (forex) for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Sunday, 6 April 2025

5 min

Saturday, 5 April 2025

8 min

Thursday, 3 April 2025

5 min