Friday Sep 27 2024 14:03

7 min

1. David Tepper says he’s buying “everything” China-related after Beijing unveils stimulus measures

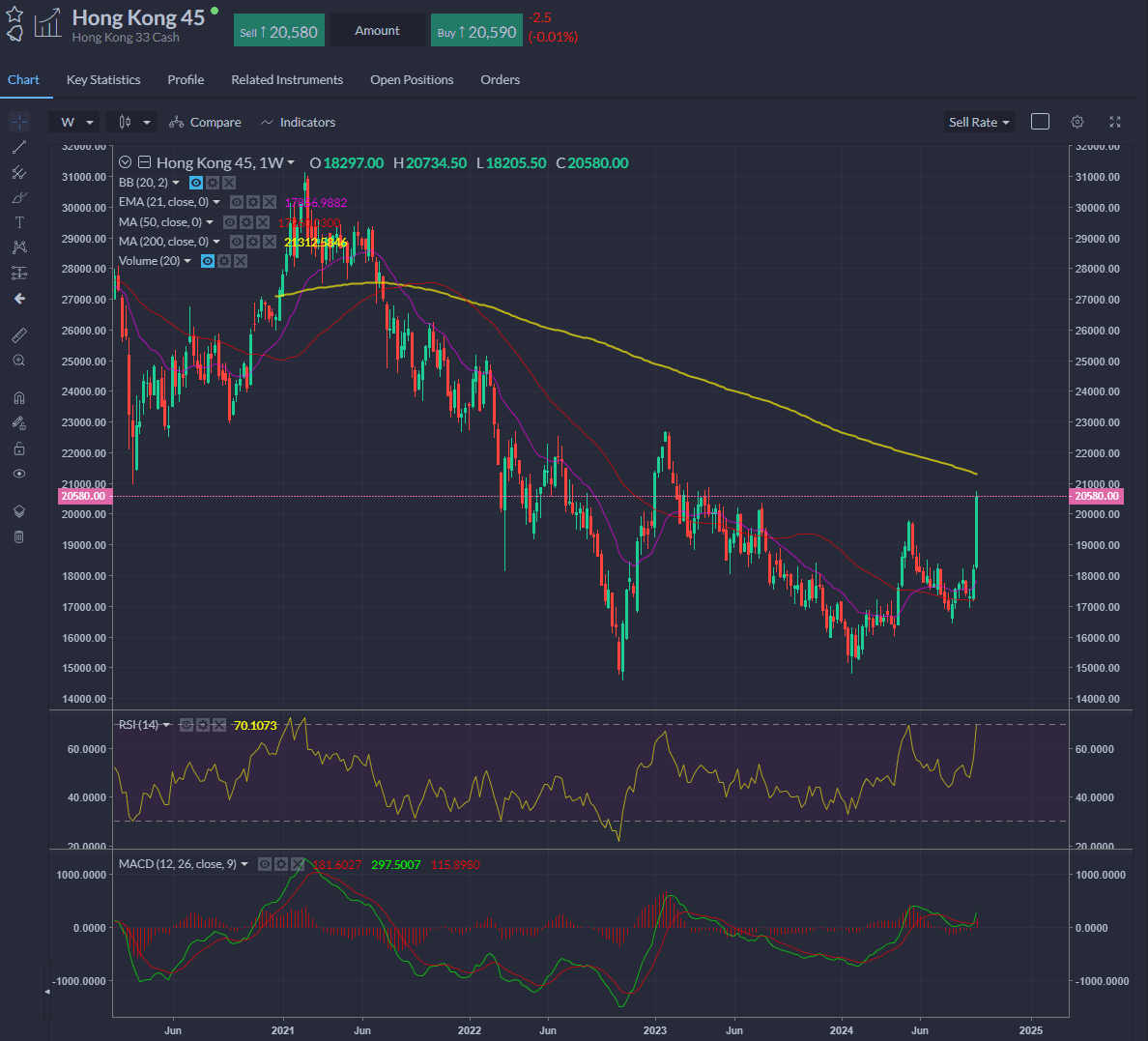

2. China stocks, Hang Seng index see best week in years on stimulus euphoria

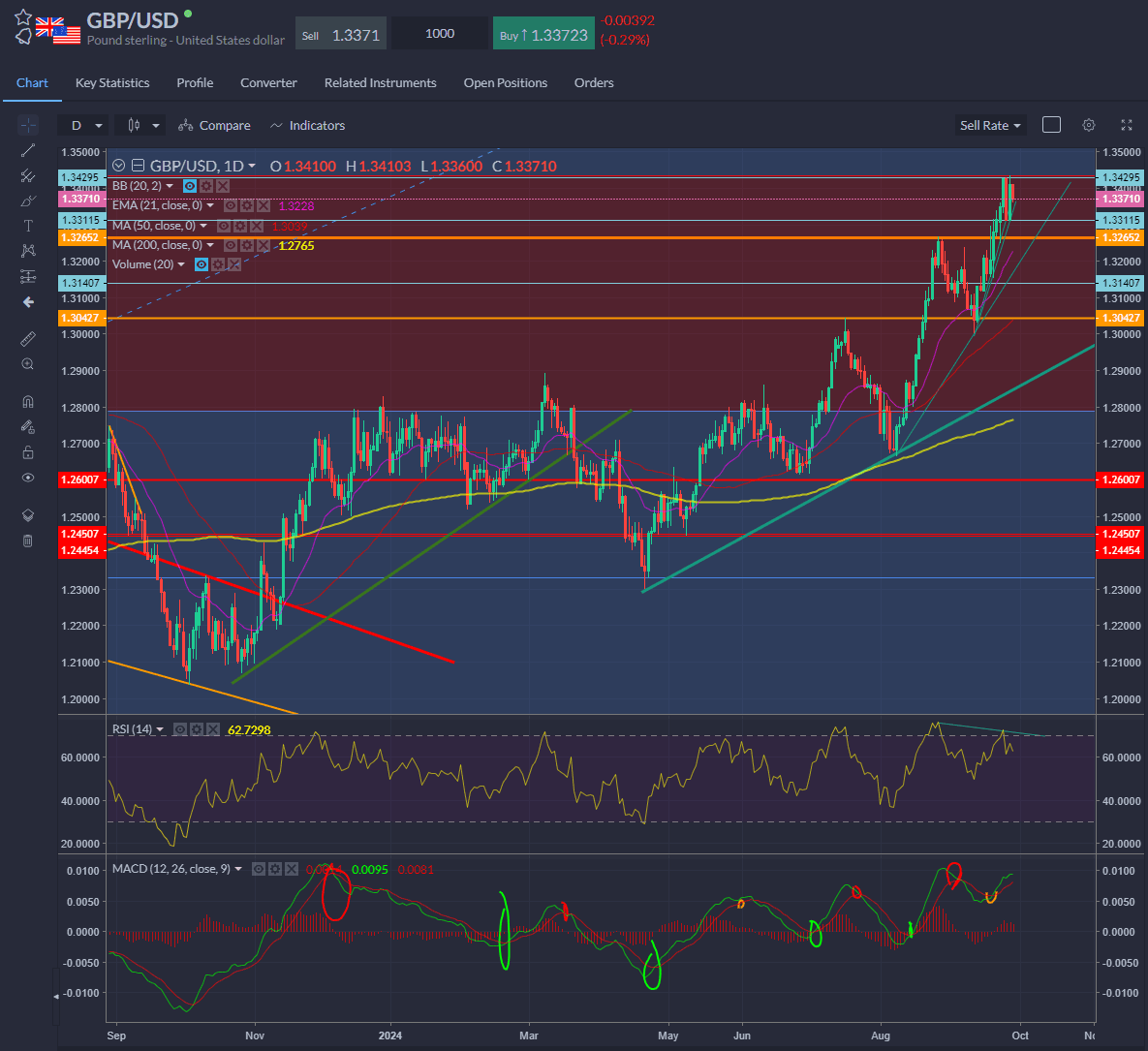

3. Sterling is best-performing G10 currency this year, up 5% vs. USD

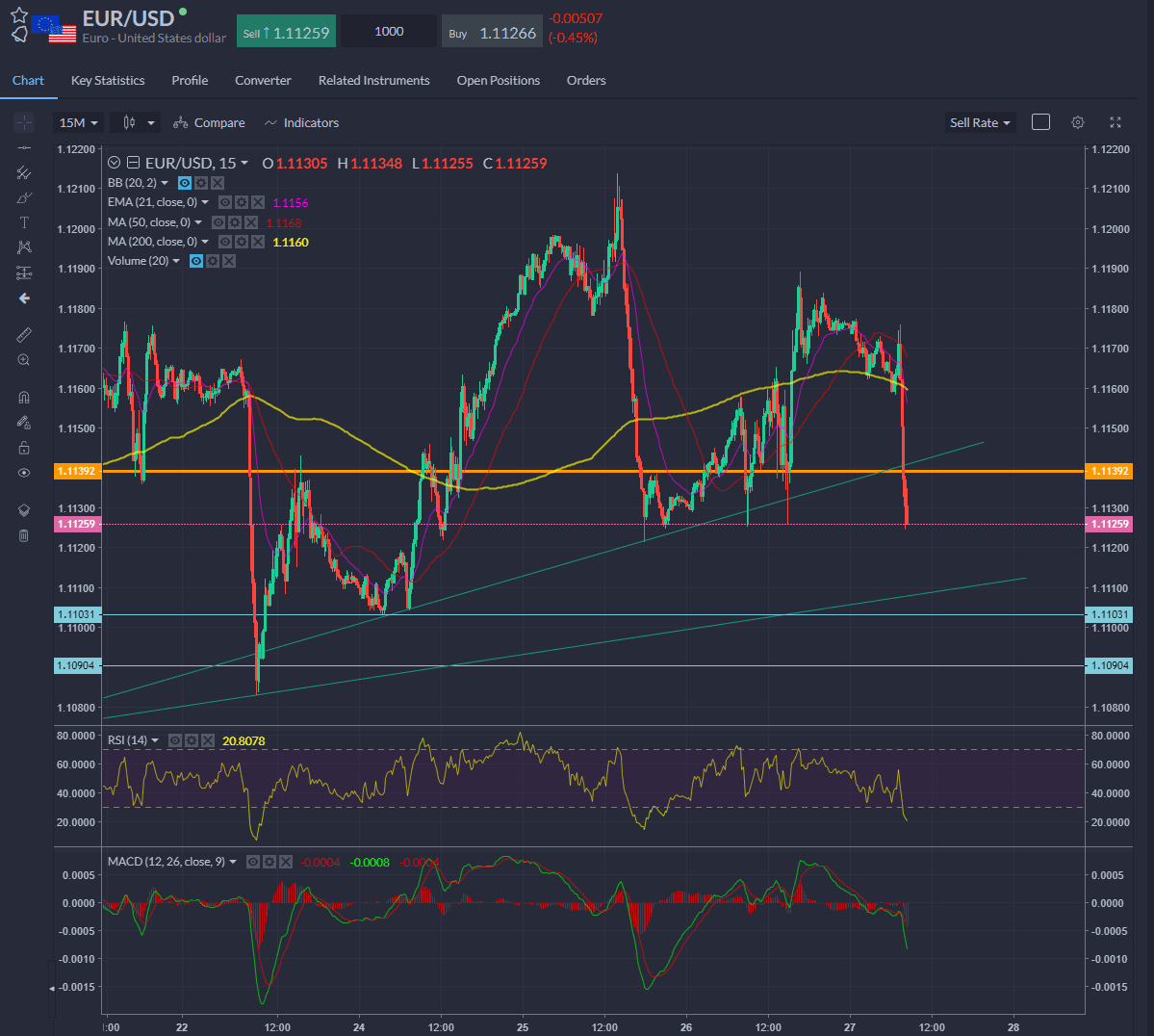

5. Bienvenue le cuts: Euro slides as soft France, Spain inflation prompts ECB dovish bets

Appaloosa Management’s David Tepper says he’s buying “everything” related to China — ETFs, futures, and stocks — right now as Beijing unleashes a range of stimulus measures. Speaking on CNBC, he said major Chinese names offer “single digit P/E (price-to-earnings) multiples with double-digit growth ... and this is the other thing, you have some of these stocks with 50% cash ... 20% cash, 30% cash”.

Tepper said to “buy everything” back in 2010 — and it seems he was right. We are in similar circumstances today. US stocks may be stretched, but China’s are not. But even so, the Fed is on side and wants growth. As Tepper points out:

“I don’t love the US markets on a value standpoint, but I sure as heck won’t be short, because I would be nervous as heck about the setup with easy money everywhere, a relatively good economy”.

“Listen to the Fed” is the message here. Tepper went on:

“Powell told you something ... He told you some kind of recalibration. He has to follow through somewhat. I’m not that smart. I just read what they say and do they have conviction. They usually do what they say, especially when they have this level of conviction.”

Undoubtedly, the Chinese authorities signalled something this week beyond just a rate cut or two. It was about saying we will do “whatever it takes” to get the economy moving again. But as Bloomberg’s John Authers points out today, it’s funny that suddenly everyone trusts the Chinese Communist Party to deliver.

Still, stocks in China and Hong Kong are on track for their best week in years. Here is the Hang Seng index weekly chart — Hong Kong's benchmark index advanced 13% this week, the best weekly gain since 1998 in a US$440 billion bull run.

The Hang Seng index is up over 21% year-to-date as of Sept. 27, slightly edging out the S&P 500, which was last up 20.45% before market open on Friday.

Away from the massive gains in equity markets, copper rallied strongly to hit its best since early July this week with a big lurch higher yesterday that has paused this morning. Gold too made another record high – the rally just keeps on going. There are lots of well-discussed reasons for this and these have not changed. Oil is taking a different direction on supply concerns.

The pound has also done well – it's the best performing G10 currency this year – up 5% against the dollar. There seems to be a mood in the U.S. and ECB to cut rates quicker than the Bank of England is willing to go. This could support some more gains but it’s about the rate of change in expectations for policy, not the relative rate of change of the policy itself.

On GBPUSD here, we can see a mild topping pattern – look to 1.3350 initially then 1.3310 support, the low from Wednesday.

On the daily chart, we can see we’ve run into some pretty big long-term resistance and the RSI has diverged with the lower high made this week — we had a peak late August at 1.3260 area after the big one-way rally from the August 7th low around 1.2660 before a retrace. This peak could be in play if we see some froth come out of this trade.

Actually, we are. Here’s something from the Kansas City Fed manufacturing survey for September:

“Most of our revenue comes from Fortune 500 companies. These customers have requested/demanded extended payment terms. Our largest customer requested that we go to Net 120 payment terms, which of course has a very negative impact on our company, most especially since our largest raw material vendor demands we pay in 15 days.”

Fortune 500 companies demanding extended payment terms is not a good sign.

France’s combined goods & services CPI was the weakest on record for September. And we have seen the softest September MoM goods inflation since '09. It was also the weakest September MoM services inflation on record. Overall, prices fell by 1.2% in September from the prior month, though we can point to the Olympics as a potential cause. Nevertheless, it just adds to the rather gloomy picture emerging in Europe.

Spain’s CPI data also came in soft. Markets are pricing in an 80% chance of a cut next month by the European Central Bank, up from 60% before the data. It’s becoming very clear that rates are too high in Europe – too slow to react because they were too worried about inflation rearing up again.

EURUSD made a clear move down on the data and looks to test recent support around 1.110.

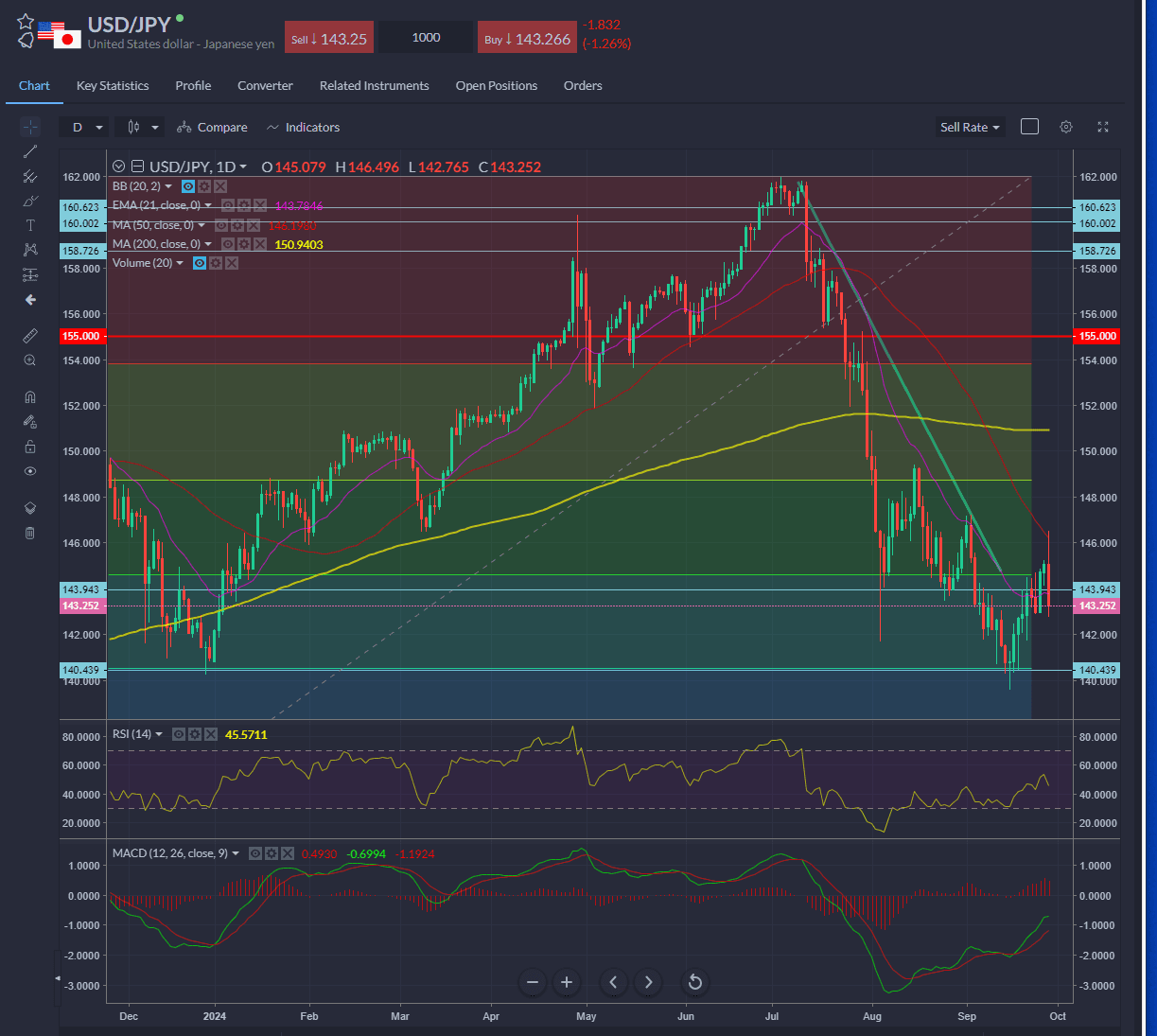

The Japanese yen rallied as former defence minister Shigeru Ishiba won the the ruling party’s leadership run-off. He’ll be installed as PM soon. He’s previously endorsed the Bank of Japan’s rate hikes and has expressed concerns about yen weakness.

USDJPY retreated sharply from the 50-day SMA and now sits above this week’s obstinate support at 143.0.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.