Wednesday Mar 13 2024 12:55

9 min

U.S. CPI inflation was hotter than expected, with the so-called “core” and “supercore” measures showing a particular stubbornness, underscoring the slowing/stalling disinflation that will keep the Federal Reserve (Fed) cautious for longer than maybe the market thinks.

The market seemed to ignore the data; bulls rode over it completely, sending the S&P 500 index up more than 1% for a fresh closing high. European stock markets also rallied in the wake of the inflation report with Frankfurt’s DAX index notching a new record high and the FTSE 100 finally breaking free from its 7,700 straitjacket to hit its best since May 2023.

Treasury yields didn’t budge that much and expectations for a June cut stay at about 66%, May down to 14% from 52% a month ago though — tjos shows traders don’t think the Fed is rushing to the exits. That said, the 10-year yield is up around 4.15% now after flirting with 4.05% on Monday.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Gold, which has been unusually buoyant of late, sold off sharply – a huge increase in net long speculative positions since late February may be about to be unwound. Stocks in Europe were a bit higher again on Wednesday morning, with the FTSE up a smidge as GDP data shows the UK returned to growth in January.

Tokyo was down as wage negotiations in Japan concluded with the biggest pay rises in 25 years. U.S. futures are flat. Bitcoin rose to a fresh high above $73,600… Is Gold/BTC breaking down again? More on debt debasement below.

I just feel inflation is starting to feel too sticky. If it keeps up like this, then you can kiss goodbye to a June rate cut and we start to question whether the Fed will be able to deliver cuts at all given how loose financial conditions are. The issue was always that inflation would reaccelerate if the Federal Reserve eased off too soon and that is exactly what it did with the December dovish pivot – the economy was not ready.

It will require more labour market weakness to secure the inflation victory. Inflation stopped going down months ago and is now anchored at a level that is materially higher than it was before the Pandemic Great Monetary Inflation — this is entirely what we expected.

I have stressed time and again that inflation is now structurally higher, and central banks would eventually need to ditch their 2% targets. Now we really test Jay Powell’s mettle.

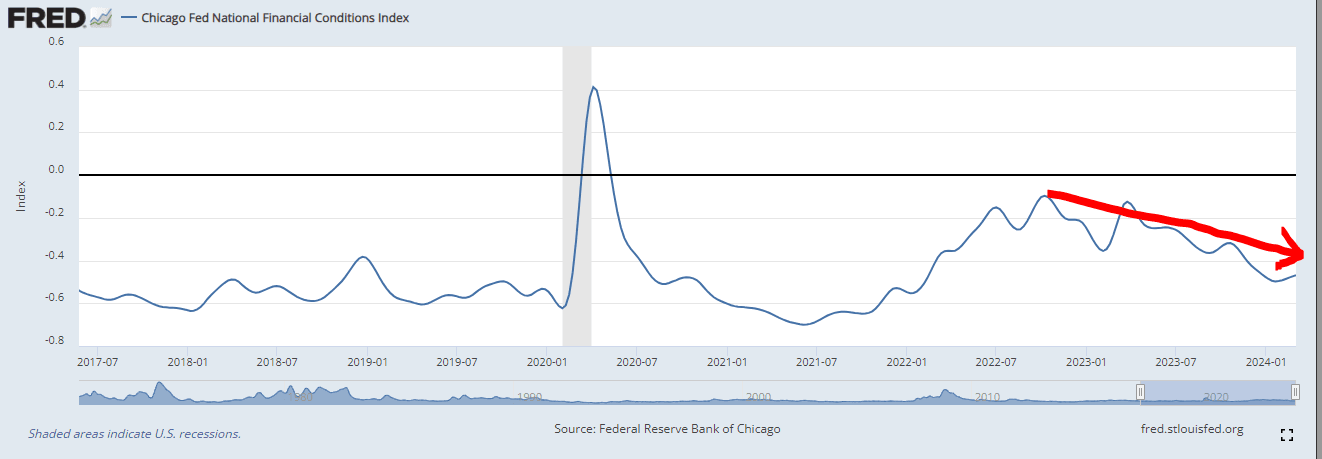

Keep repeating it – financial conditions have been getting looser since October 2022 despite the hikes.

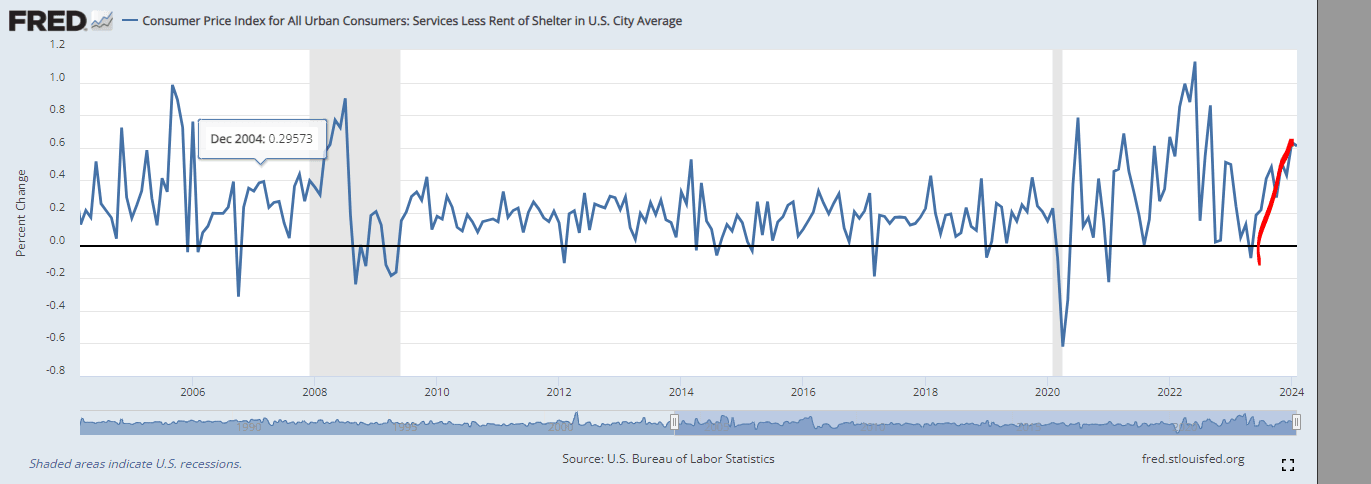

Headline CPI rose by 3.2% YoY last month. Core CPI was still a very stubborn 3.8% YoY, from 3.9% YoY in January, while the “supercore” inflation measure remained unchanged at 4.3% YoY.

On a 3-month annualized basis, CPI core services ex-housing (“supercore”) increased by 6.9% in February, but month-on-month it was down from 0.87% in Jan to 0.47% in February. There had been some fear that this would bump again so this may explain the market’s sangfroid. Imagine trading to figure all this out – no wonder bulls just said “screw it, we’re buying this.”

The services component is a problem .

Goldman Sachs notes that while the CPI ran hot, the composition “was disinflationary,” going on to add:

“[...] With a sharp normalization in non-housing services inflation and a return to the Q4 trend for the owners’ equivalent rent category. We also expect the rise in used car prices to more than reverse this spring. We continue to expect the FOMC to leave the Fed funds rate unchanged at the March meeting and to begin the easing cycle in June.”

We talked earlier this week about the "debt debasement” trade powering equities, bitcoin and gold to records.

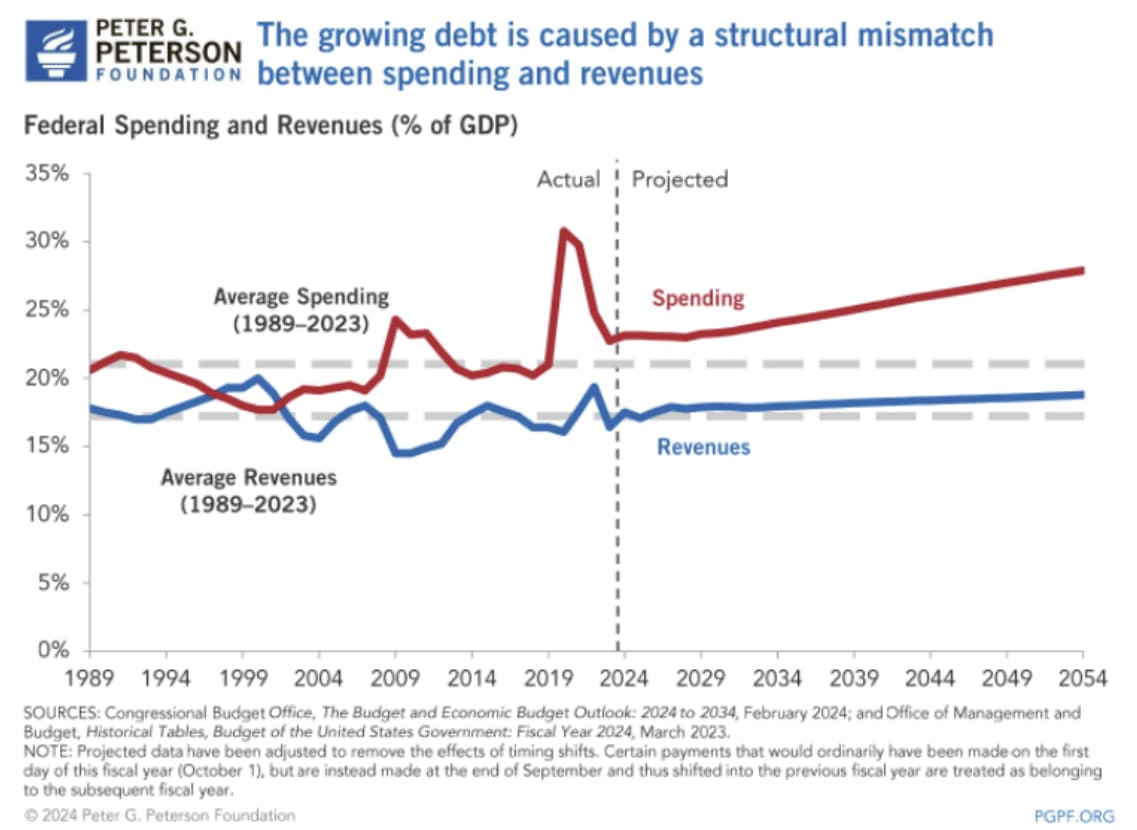

So, Monday saw President Biden unveil his $7.3tn budget proposal. It involves $5.5tn in tax hikes, spends $300 billion more in the 2025 fiscal year than the previous year, and purports to cut the Federal deficit by $3 trillion over ten years. No one thinks it will pass Congress, so it’s not exactly been top of the agenda for traders.

But it underlines the predicament facing the U.S.: ever-increasing debts and deficits. The Office of Management and Budget (OMB) estimates indicate that U.S. national debt would rise to $45.1 trillion — or 105.6% of GDP — by 2034 under the plan, up from $27.4 trillion.

Here’s an analysis of the proposal from the Committee for a Responsible Federal Budget:

The President’s budget encouragingly pays for new initiatives and reduces deficits. However, it falls short of proposing the necessary deficit reduction that is needed to put the nation on a sustainable fiscal path and fails to recognize the immense cost of extending expiring tax provisions. It includes important measures to improve Medicare solvency and sustainability but fails to say how it would avoid Social Security insolvency. Still, the proposed $3.3 trillion of net deficit reduction would represent an important step toward long-term fiscal sustainability.

We took a closer look at budget deficits — and if they matter — in the latest edition of Finalto’s podcast, Overleveraged.

When considering shares, indices, commodities, or forex (foreign exchange) for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Sunday, 6 April 2025

5 min

Saturday, 5 April 2025

8 min

Thursday, 3 April 2025

5 min