Wednesday Jan 15 2025 07:22

4 min

The recently released cooler-than-expected Producer Price Index (PPI) data has put pressure on the U.S. dollar and benefitted gold, as lower inflation might prompt the Fed to cut rates sooner. However, investors are now focused on the upcoming Consumer Price Index (CPI) report, with economists forecasting a 2.9% annual increase, to gauge the Fed's next policy decision. Additionally, with President-elect Donald Trump starting his second term next week, his policies and tariffs could influence a more hawkish stance from the Fed.

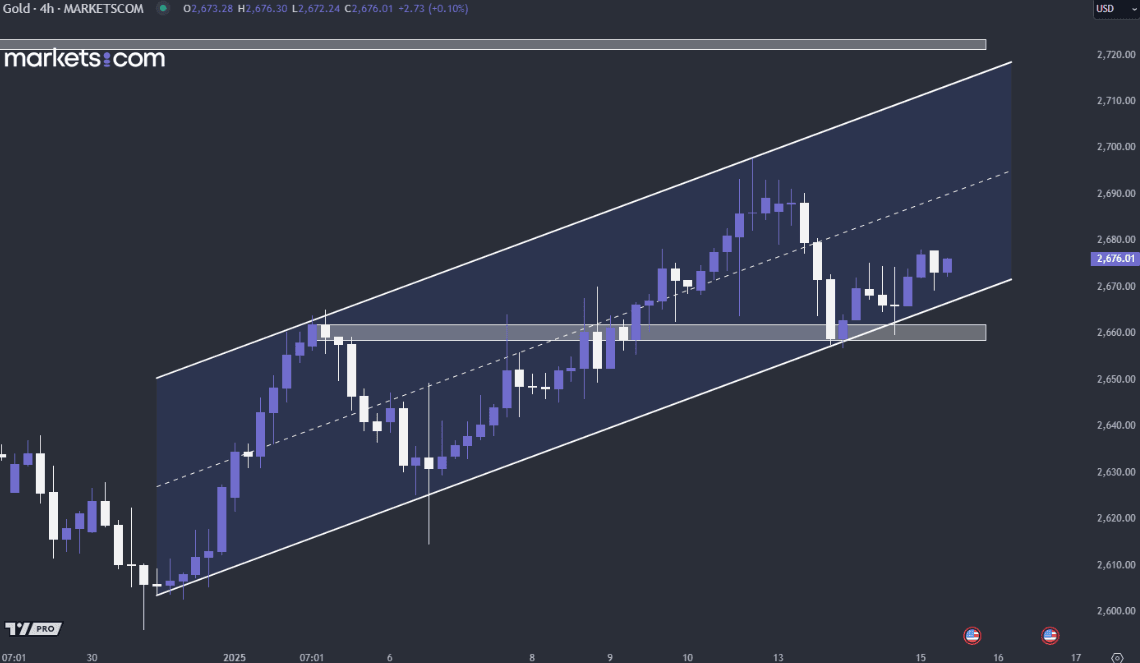

(Gold 4H Price Chart, Source: Markets.com)

From a technical analysis perspective, gold's overall trend remains bullish, as indicated by the formation of higher highs and higher lows within the ascending channel. It recently found support and rebounded from the previous support zone, driving the price upwards. Once the price can form higher highs and break through this ascending channel upwards, it may continue to challenge the rectangular resistance zone above.

The UK CPI figures for December, due today, will be pivotal for expectations of a possible rate cut next month. Growing anticipation for a Bank of England rate cut in February could lead to significant bearish pressure on the GBP/USD pair. Futures markets are pricing in a 16-basis point cut at the BoE's February meeting, with a chance estimated at 65%.

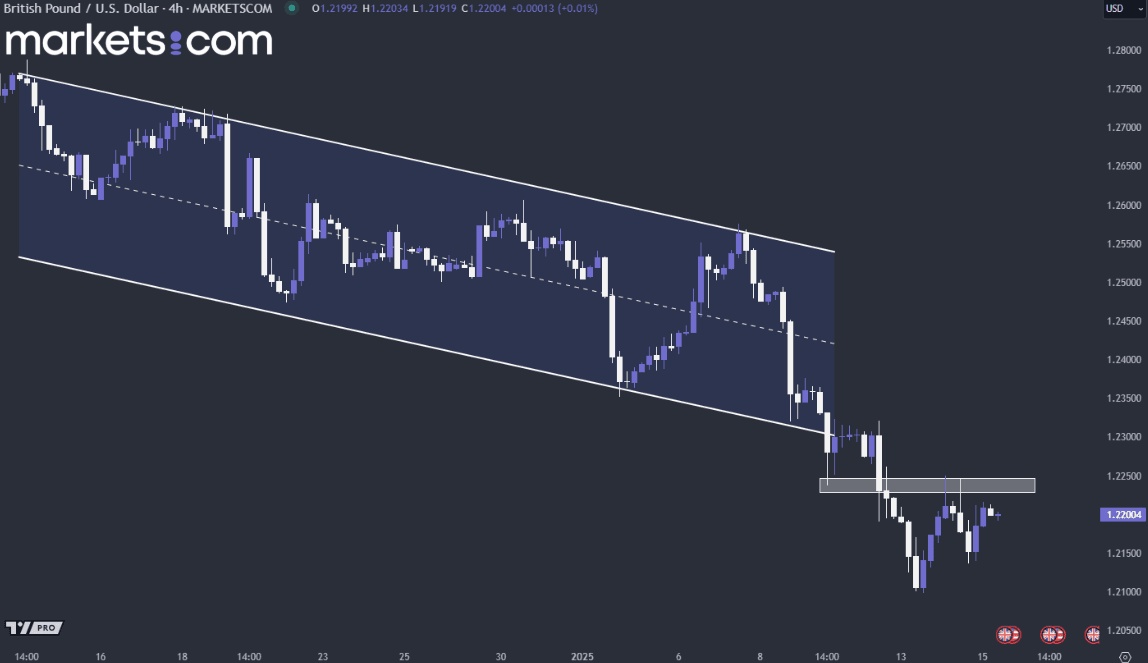

(GBP/USD 4H Price Chart, Source: Markets.com)

From a technical analysis perspective, the overall trend of the GBP/USD remains bearish, as indicated by the formation of higher highs and higher lows. Moreover, the recent significant bearish momentum has broken through the descending channel, driving the price further downwards. The price rebounded and retested the previously broken structure, as indicated in the rectangular zone. It was being rejected and driving the price downwards, which suggests a high possibility of bearish continuation.

In anticipation of the release of its fourth-quarter financial results today, the stock of JPMorgan rose, buoyed by investor optimism surrounding the banking behemoth. Net income for the December quarter is expected to be $11.92 billion, projected to be around a 30% gain compared to last year. However, the net interest income is expected to decline to $22.93 billion from $24.05 billion last year, as lower interest rates have eroded the bank’s profit margins.

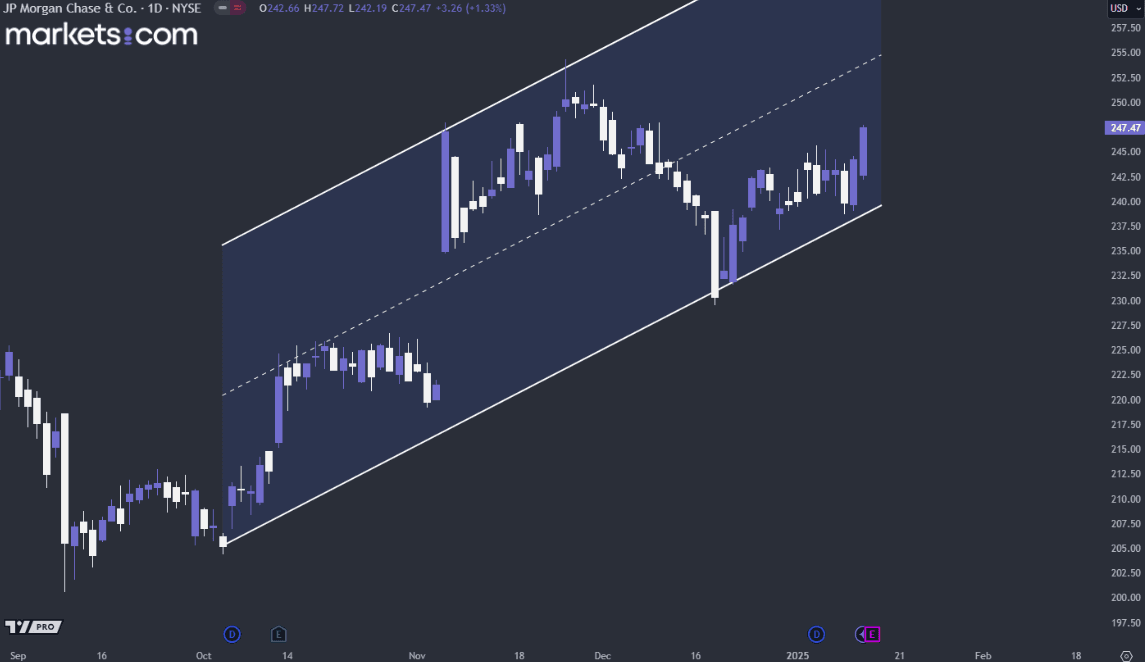

(JPMorgan Stock Daily Price Chart, Source: Markets.com)

From a technical analysis perspective, the overall trend of JP Morgan stock remains bearish, as indicated by the formation of higher highs and higher lows. It has rebounded to fill the previous gap-up area and resumed its bullish movement afterwards. Based on such solid price action and bullish structure, the price will likely continue its bullish momentum and move upwards.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min