Wednesday May 15 2024 11:12

7 min

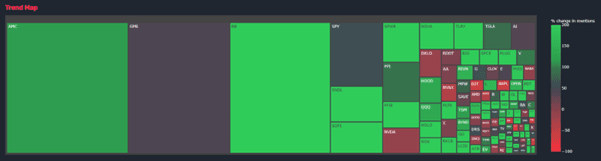

Global shares hit a record high this morning and meme stocks are going bonkers again — it’s all very top-of-the-cycle kind of feel.

Today’s US inflation print is the key event of the week. The market seems braced for a downside surprise so anything a bit hot could kick markets back. Markets do not seem concerned about Biden slapping yet more tariffs on China — the US inflation data release is very much in focus.

The MSCI All-Country World Index hit a new all-time high this morning after achieving a fresh record last night. It’s now 6% above the April low and London is at the vanguard of the rally, achieving a fresh record high this morning.

It’s now risen about 9% from the April trough after gaining about half a percent in early trade this morning with Experian the top riser with a gain of 8% after reporting growth at “the top end of our expectations”, whilst Burberry suffered a 4% decline in revenues to weigh on the luxury sector.

European indices were mainly higher early on Wednesday ex-Paris due to the luxury move lower, with the Stoxx 600 hitting a record high. Wall Street rose on Tuesday in spite of producer price inflation (PPI) coming in hotter than expected. The Nasdaq Composite added three-quarters of a percent to hit a record closing high and the S&P 500 index was up half a percent.

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Meme stocks were soaring again yesterday. GME stock rose 60% and is up about 5% after-hours; AMC rallied 30% and is +10% after-hours and BlackBerry rose 12% and extended another 6% after the close.

None finished close to the pre-market heights though. It still appears that block trades were light, mostly retail-sized 100-share orders — it seems likely that it’s mainly retail-driven. And stocks here were caught up.

The read across the Atlantic indicates the dysfunction of markets – Ocado soared and other heavily shorted stocks in Europe were among yesterday’s best risers.

The thinking is that retail will go after some of them in a Reddit-style attack on shorts; hedge funds that are short will have reacted swiftly to Monday’s moves in New York to cover some of their positions as a precaution.

Other stocks with a lot of short interest like SunPower (+60%) and MicroCloud Hologram (+61%) rallied but it wasn’t the case that all of the companies with the highest proportion of outstanding shares currently sold short rose. There is some giveback today for Ocado with the stock down 4% early doors.

There are lots of meme stocks, but a handful dominate and only a relatively small number catch the attention of investors at any given time.

US PPI was hotter than expected at +0.5% MoM, whilst core PPI also increased 0.5% compared to the 0.2% estimate. Yields initially pushed up with the 10-year Treasury note rising above 4.5% before drawing down to 4.43% this morning.

Yields initially bounced on the beat but details on insurance, medical care, and airfares showed a milder reading than the headline indicated. Speaking at a banker summit, Fed chair Jay Powell said: "I wouldn’t call it hot. I would call it sort of mixed."

With Treasury yields slackening and the risk sentiment picking up a notch in the last day or so, the dollar eased back further to its lowest in almost two weeks.

This takes us today’s big macro event — the US inflation print. Forecasters think the core CPI rose 0.30% in April, which would lower the 12-month rate to 3.6% from 3.8% in March. Headline CPI is projected at +0.37% in April, taking the 12-month US inflation rate to 3.4% from 3.5% in March. Powell also noted that confidence in inflation moving back down is “lower than it was”.

No wonder BHP Group is after Anglo-American and its copper projects.

The copper price has broken out and smashed a record high, breaking above $5 a pound for the first time, with the May, Jun and July contracts all trading above this level this morning. There has not been enough investment in copper supply — metal is a key component in multiple industries, such as electric vehicles and other carbon reduction measures, as well as the defence industry and the production of munitions.

A major leg up in the copper price is likely, while a doubling in the next 5 years is not unreasonable. It takes so long to develop mines that prices can remain very elevated for a while yet and demand is only rising. As Goldman Sachs put it last month, copper is in “the foothills of what will be its Everest”.

Finally, Huw Pill, chief economist at the Bank of England, nudged markets closer towards June being the time for the first rate cut in years, saying hopes of a summer rate cut were “not unreasonable”.

Sterling still kicked on a bit, though as a) this is widespread knowledge, b) UK data is getting better and c) risk-on sentiment tends to support GBP.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min

Monday, 31 March 2025

5 min