Thursday Dec 26 2024 03:11

5 min

Stock market today, US stocks rallied in the final, shortened trading session before the Christmas holiday.

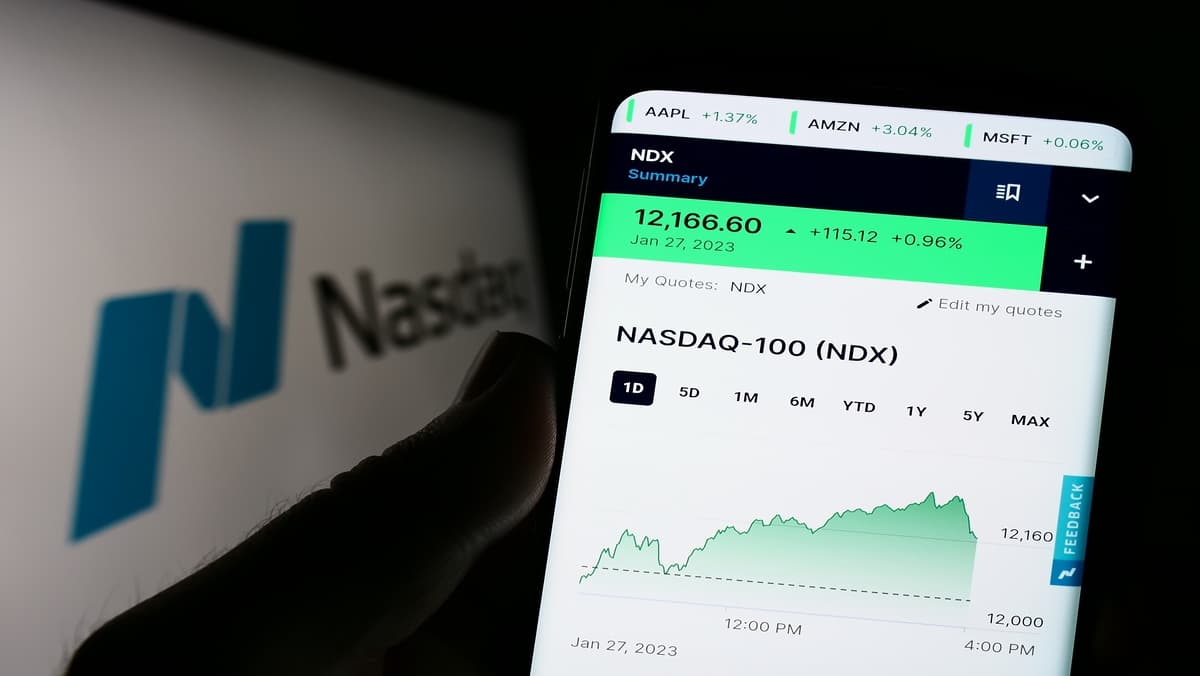

The benchmark S&P 500 (^GSPC) finished the session up over 1.1%, while the tech-heavy Nasdaq Composite (^IXIC) rose roughly 1.4%. The Dow Jones Industrial Average (^DJI) climbed around 0.9%.

Wall Street successfully entered its Christmas break rejuvenated, after tech stocks including AI chip giant Nvidia (NVDA) led the march higher. Markets closed at 1 p.m. ET and are off tomorrow for Christmas Day.

Wall Street is reevaluating the trajectory of interest rates for next year, recognizing that the Federal Reserve has largely achieved a "soft landing," but has not completely resolved the inflation issues facing the U.S. economy. According to the CME FedWatch tool, most investors anticipate that the Fed will maintain rates during its January and March meetings, with uncertainty surrounding the May meeting.

At the same time, attention remains focused on Nvidia, which saw an uptick on Tuesday after a 3.5% rise on Monday. As noted by Yahoo Finance's Dan Howley, 2024 has been a standout year for Nvidia, with the stock climbing approximately 180%. However, 2025 may present a range of challenges for the company.

As the holiday season approaches, Wall Street is seeing a surge of optimism, with the Nasdaq, S&P 500, and Dow Jones all recording significant gains. Investors appear buoyed by positive economic data and easing concerns about inflation, propelling markets upward in the final trading days before the Christmas break. Technology stocks have been a standout, driving much of the Nasdaq’s momentum, while industrial and financial sectors have bolstered the Dow.

Several factors are contributing to this market rally. Reports of resilient consumer spending during the holiday shopping season have lifted sentiment, countering earlier fears of a slowdown in economic activity. Additionally, better-than-expected inflation data has sparked hopes that the Federal Reserve may adopt a more temperate approach to rate hikes in the coming months. Coupled with lower-than-anticipated unemployment claims, the broad market is experiencing a wave of confidence.

Recent economic indicators reveal that inflation is moderating, with core Consumer Price Index (CPI) figures closely matching market forecasts. This alignment has sparked speculation that the Federal Reserve’s tightening cycle may be approaching its peak, potentially allowing for a shift in monetary policy. The data suggests that the Fed may ease its aggressive stance, which could benefit the broader market.

Importantly, consumer spending remains robust, highlighting the resilience of the economy as it heads into the new year. Strong consumer demand is a key driver of economic growth, and its persistence suggests that households are still willing to spend despite previous rate hikes. This resilience could provide a solid foundation for the markets, creating a favorable environment for investments.

Analysts believe that these conditions could pave the way for markets to maintain an upward trajectory in early 2024. As investor sentiment improves and economic stability is reinforced, there is potential for increased capital inflows into equities and other asset classes. Overall, the combination of moderating inflation and strong consumer spending paints an optimistic picture for the market outlook in the upcoming year.

Looking ahead, market activity is expected to taper off as the Christmas break nears, but analysts remain optimistic about the potential for a sustained rally. Traders will be paying close attention to further economic releases, including housing data and preliminary Q4 earnings reports, as they evaluate the market's prospects post-holiday. Investors seem poised to celebrate not only the holidays but also the stock market's impressive year-end performance.

As the Christmas break approaches, market activity is anticipated to slow down, but analysts maintain an optimistic outlook for a sustained rally. Traders will closely monitor upcoming economic releases, including housing data and preliminary fourth-quarter earnings reports, to assess the market's prospects after the holiday season. These indicators will be crucial in determining whether the current momentum can carry into the new year.

Additionally, investors appear ready to celebrate not only the holidays but also the stock market's impressive performance this year. With strong consumer spending and moderating inflation, there is a sense of confidence in the market's resilience. This positive sentiment may encourage further investment activity as traders position themselves for potential opportunities in early 2024. Overall, while market activity may taper, the foundation for continued growth remains solid, making for an optimistic end to the year.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.