Monday Jan 6 2025 06:38

6 min

Stock price forecast, investors are keenly interested in identifying stocks that have the potential to outperform the broader market, here are 4 S&P 500 stocks for 2025.

Dividend stocks are a popular choice among investors for compelling reasons. They not only provide a reliable source of passive income but also represent a promising avenue for total return. Total return is an all-encompassing measure of investment performance, incorporating interest, capital gains, dividends, and distributions realized over time.

The S&P 500 has seen impressive gains of over 20% in both 2023 and 2024, marking the first occurrence of such back-to-back years of 20% growth since the 1990s. However, many stocks within this established index have traded sideways despite these overall gains.

For investors considering their portfolios, particularly those interested in dividend stocks, 2025 presents an opportunity to assess the best options available. With many top dividend stocks offering some of the highest yields in over a year, now is a great time to evaluate potential investments.

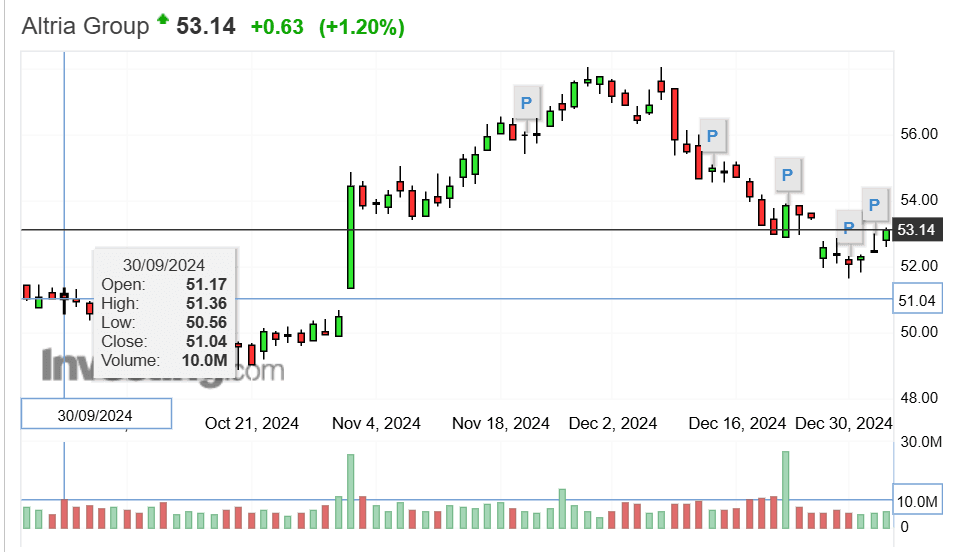

Altria Group, Inc. is a leading producer and marketer of tobacco products, primarily known for its flagship Marlboro brand. With a robust market presence in the U.S., Altria also offers a range of smokeless tobacco products and e-vapor alternatives. The company has faced significant challenges in recent years due to increasing regulatory scrutiny and changing consumer preferences, particularly around smoking. However, Altria remains a strong dividend payer, offering a generous yield of approximately 7.58%, making it an attractive option for income-focused investors.

In addition to its core tobacco business, Altria has made strategic investments in non-tobacco sectors, including a notable stake in the cannabis company Cronos Group. This diversification could provide long-term growth opportunities, particularly as the cannabis market continues to expand. Despite facing headwinds, Altria's ability to generate steady cash flow allows it to maintain its dividend and invest in future growth. As investors look for stable income streams in a fluctuating market, Altria’s rich dividend yield and potential for recovery position it as a noteworthy candidate for 2025.

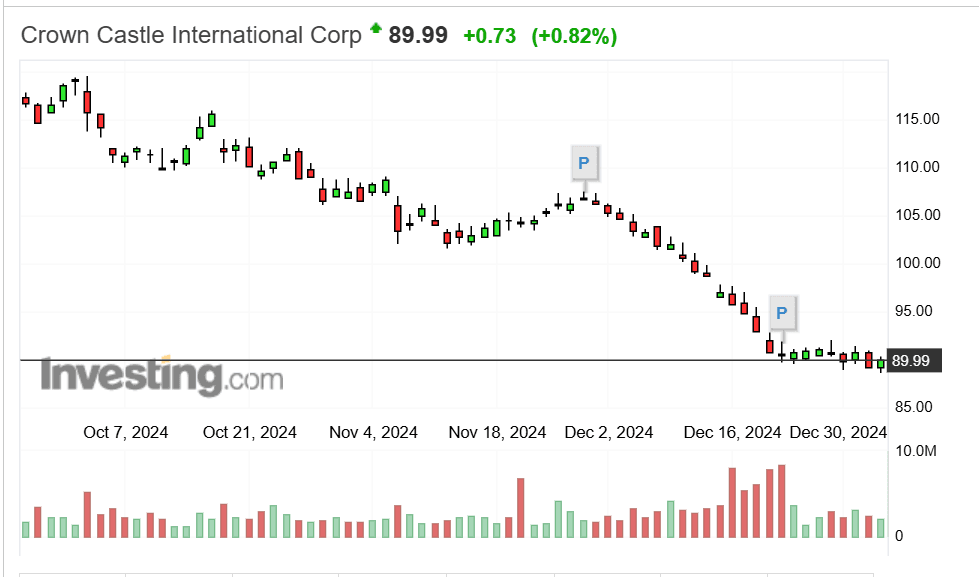

Crown Castle International Corp. is the largest provider of shared communications infrastructure in the U.S., specializing in wireless tower leasing and fiber optic solutions. With over 40,000 towers and approximately 90,000 route miles of fiber, Crown Castle supports the growing demand for mobile data and connectivity, positioning itself as a critical player in the telecommunications sector. The company's business model benefits from long-term leases with major wireless carriers, providing a steady revenue stream and contributing to its impressive dividend yield of around 6.91%.

As 5G technology continues to roll out, Crown Castle stands to gain significantly from increased demand for infrastructure capable of supporting high-speed wireless networks. The company’s focus on expanding its fiber network enhances its growth potential, while its diversified revenue streams mitigate risks associated with reliance on any single technology or carrier. With a commitment to returning capital to shareholders through dividends and share buybacks, Crown Castle is an appealing option for investors seeking both income and growth in the evolving telecommunications landscape.

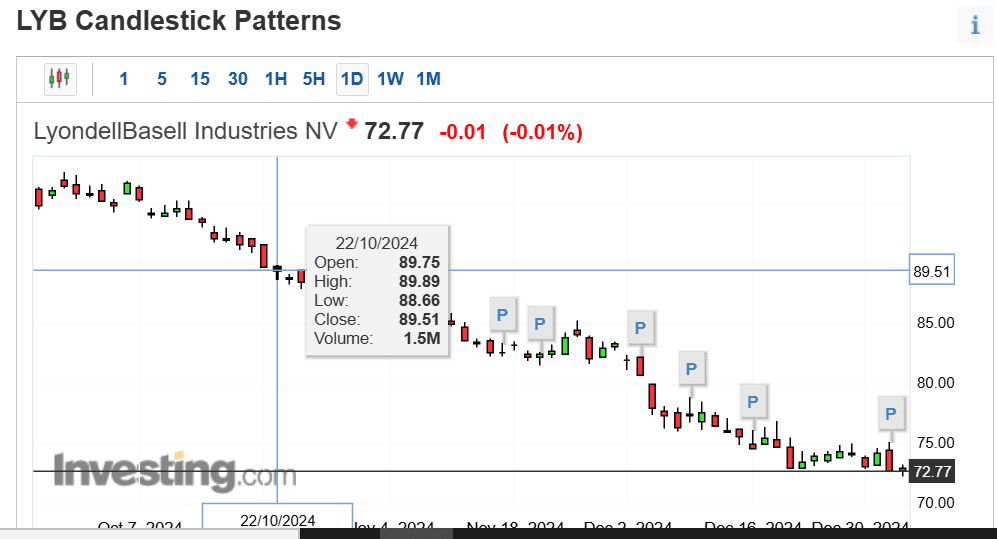

LyondellBasell Industries N.V. is a global leader in the production of chemicals and polymers, serving diverse industries such as packaging, automotive, and construction. Operating in numerous countries, LyondellBasell boasts a comprehensive portfolio that includes olefins, polyolefins, and advanced polymer solutions. The company is known for its commitment to innovation and sustainability, investing in technologies that reduce environmental impact while meeting market demands. With a substantial dividend yield of approximately 7.22%, LyondellBasell is particularly attractive to income-focused investors.

The company benefits from its scale and integrated operations, allowing it to optimize production and reduce costs. As global demand for materials continues to rise, LyondellBasell is well-positioned to capitalize on growth opportunities in emerging markets and industries. Furthermore, its strong balance sheet enables ongoing investments in capacity expansion and technological advancements. While the chemical industry can be cyclically volatile, LyondellBasell’s diverse product offerings, combined with its commitment to shareholder returns, make it a compelling choice for investors looking for a blend of income and long-term growth.

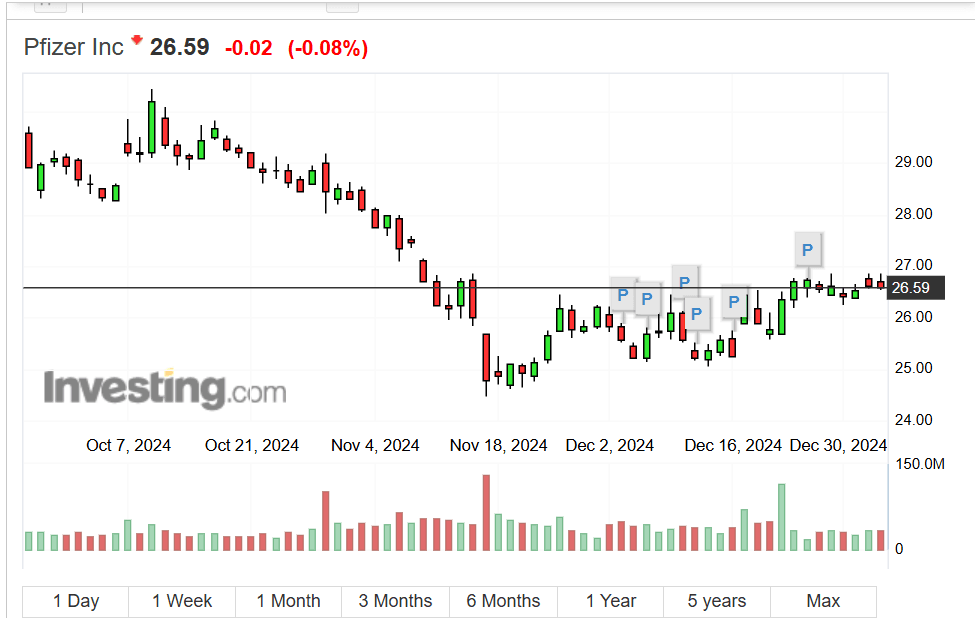

Pfizer Inc. is a multinational pharmaceutical company renowned for its innovative biopharmaceutical products and vaccines, including the highly successful COVID-19 vaccine, Comirnaty. With a diverse portfolio that spans various therapeutic areas, including oncology, immunology, and cardiology, Pfizer has established itself as a leader in the pharmaceutical industry. Despite facing challenges as demand for COVID-19 vaccines declines, Pfizer continues to provide a robust dividend yield of approximately 5.75%, appealing to income-seeking investors.

The company's extensive research and development pipeline is a significant factor in its long-term growth strategy, with numerous products expected to launch in the coming years. Pfizer’s commitment to innovation is evident in its focus on biologics and personalized medicine, which are poised to drive future revenue growth. Additionally, its strong financial position allows for ongoing investments in R&D and potential acquisitions. Trading at attractive valuations, Pfizer presents an opportunity for investors to gain exposure to a leading pharmaceutical company with a solid dividend history and a promising product pipeline, making it a noteworthy stock for 2025.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.