Wednesday Apr 24 2024 10:55

8 min

Equity markets are on the front foot again with shares across Europe rallying in early trade on Wednesday after some good news (?!) from Tesla seemed to reignite risk appetite and Wall Street closed firmly in the green.

The FTSE 100 index rallied to a fresh all-time high at 8,091 at send time after a positive handover from Asia led by a third straight day of gains for Hong Kong stocks.

Lloyds shares fell a touch as profits declined 28% as the tailwinds of interest rate hikes faded. Pre-tax profits were a bit light at £1.6bn vs £1.7bn expected, with net interest margins down a fraction.

Underlying net interest income of £3.2 billion was down 10 per cent, with a lower banking net interest margin of 2.95 per cent, down from 2.98% per cent. There is a lot more competition for mortgages and deposits. Maybe Labour won’t go after the banks…

Сalculate your hypothetical P/L (aggregated cost and charges) if you had opened a trade today.

Market

Instrument

Account Type

Direction

Quantity

Amount must be equal or higher than

Amount should be less than

Amount should be a multiple of the minimum lots increment

USD

EUR

GBP

CAD

AUD

CHF

ZAR

MXN

JPY

Value

Commission

Spread

Leverage

Conversion Fee

Required Margin

Overnight Swaps

Past performance is not a reliable indicator of future results.

All positions on instruments denominated in a currency that is different from your account currency, will be subject to a conversion fee at the position exit as well.

Elsewhere, luxury headaches abound – Kering is down 8%, Burberry falling 3% in sympathy. Chips are boosted as ASMI raised its Q2 outlook on Chinese demand — chipmakers leading the way in Europe this morning. Chip shares notably brought down U.S. stock markets — and the Magnificent Seven — last week, with the Nvidia market cap alone shedding over $300bn.

Basic resources are the best-performing sector, with bond proxies' real estate and utilities down the most. Reckitt beat forecasts, Heineken posted a 7% rise in revenues as volume growth returned, and Volvo revenues missed.

Investors seemed to get the added clarity they were seeking on mass market (Model 2) vehicles from Tesla.

Tesla shares rallied 13% after hours to $164 as the company said it has “updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025”.

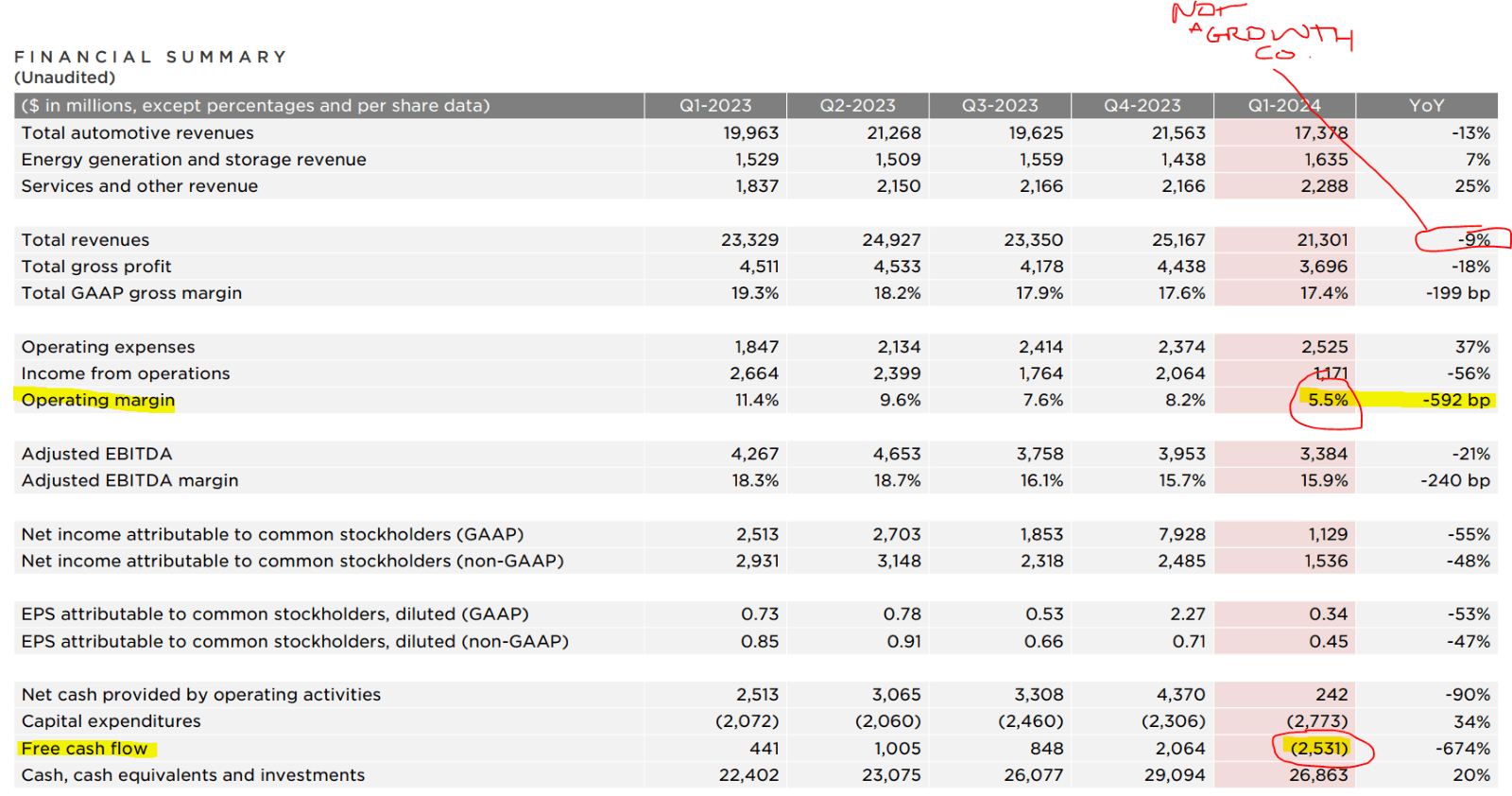

CEO Elon Musk said on an earnings call that production would likely be in "early 2025 if not late this year" and it would include "more affordable models.” The rally in Tesla shares came despite a 9% drop in first-quarter revenue, the biggest decline since 2012. Shorts maybe had timed out – short interest has grown and maybe just a bit of stopping out.

First quarter adjusted earnings per share declined to $0.45, below the $0.52 estimated, on revenue of $21.30 billion vs. the forecasted $22.3bn. Operating profit fell to $1.2bn and adjusted net income fell to $1.5bn, both down 50%. There was a definite sense that the Q1 numbers were not as bad as feared – Tesla shares have derated massively this year already on falling sales and prices. But this was anything but a quarter in which all the questions have been answered: I’d call it troubling.

There wasn’t much detail. Autonomy, robotaxis and a ride-hailing app were mentioned – Musk has been going on about the former for the past eight years. Musk’s refusal to answer questions from AllianceBernstein’s Toni Sacconaghi about the Model 2 also wasn’t one of the earnings call’s confidence-inspiring moments.

Then margins – down to 5.5% and that includes full self-driving (FSD) recognition and credit sales...

In fact, Tesla reported averaged prices of +1.5% in the quarter despite 4%-6% price cuts globally, which may suggest they are recognising deferred FSD revenues.

Here’s Adam Jonas from Morgan Stanley:

"It’s worth pointing out that the profitability of Tesla is currently substantially lower than that of internal combustion makers and that is with the benefit of monetizing regulatory credits, downstream retail operations and other high-margin software contributions."

Yes, it is worth pointing this out.

But Elon Musk says the stock should be valued as a robotics company — not an automaker:

“I think Cathie Wood said it best. Like really, we should be thought of as an AI or robotics company. If you value Tesla as just as an auto company, you just have to -- fundamentally, it's just the wrong framework and if you ask the wrong question, then the right answer is impossible.”

At the time of writing on Wednesday, Tesla shares were down close to 20% over the past month and 42% year-to-date. Multiple analysts, such as Morgan Stanley’s Adam Jonas, have downgraded their Tesla share price forecasts since January.

Meta reports later – analysts forecast revenue growth accelerating for a fifth straight quarter to 26%.

Japan’s former currency chief Mitsuhiro said the country is very close to intervention if the yen falls more. One lawmaker, Takao Ochi, who is a senior member of the Lower House Financial Affairs Committee, suggested USD/JPY at 160 could provoke action – that line in the sand keeps moving. Yen intervention talk has been rife for the past several weeks.

A decent services PMI and some comments from the Bank of England’s (BoE) chief economist helped lift the British pound, which had hit its weakest against the dollar in five months; GBP/USD bounced off the 1.230 round number Fibonacci support level on Monday to reach 1.2464.

Huw Pill warned against cutting rates too soon; highlighting a downward shift in inflation dynamics. He suggested that the passage of time and no news makes the BoE closer to a cut, things haven’t changed much since March.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Thursday, 19 December 2024

5 min

Thursday, 19 December 2024

3 min

Wednesday, 18 December 2024

3 min