Wednesday Sep 13 2023 10:00

6 min

Stocks are generally weaker after Apple and Oracle pushed down sentiment in the US tech space, whilst oil is extending gains, and the dollar nudges up off its support. Shares were weaker in mainland Europe with the DAX and CAC both shedding around a third of a percent at the open after Wall Street declined and Asia was broadly weaker overnight.

In London, the FTSE 100 traded a bit lighter early on Wednesday before recovering a level head, with BP shares falling initially after the shock departure of CEO Bernard Looney before trimming losses and turning marginally higher on the session with oil extending gains. That’s all folks – Looney tunes out...etc etc, and other bad jokes. Usual ‘succession planning’ reaction...blah blah they will find someone. On a serious note, it’s been pretty clear that the net zero ambitions of the oil majors are coming up against reality. The reality of keeping the lights on and in the case of BP paying too much for wind. BP was starting to look like an outlier in terms of its ambitions to step away from fossil fuels – his successor should consider a more pragmatic approach – that could see BP’s share price catch up with peers.

Apple was a bit of a nothing-burger...pricing power is ok, ecosystem still super strong...people will upgrade but nothing we didn’t know already. Oracle is the outlier – slipping 13% for its worst day since 2002. Not a big stock – around $300bn market cap - but its revenue miss and weak guidance weighed across the cloud computing space to drag the Nasdaq down by 1% for the session.

Oil – steep backwardation points to very tight supply as the spread between front month Brent and contracts further out widened to the most since November. At $4.78 it’s smacking of a scramble for barrels with physical demand still high and expectations for a supply shortfall in the back end of the year and into 2024. OPEC says market will be 3.3m bpd short in the fourth quarter – that is not a small amount but Iran is pumping more so shaves some of that. Higher oil prices are feeding into higher inflation expectations – US2yr breakevens at highest since April and the 2yr Treasury yield back above 5%. 10yr Treasury yield sits just a whisker under 4.30% and seems eager to pop – note the Jamie Dimon comments about not being a buyer here.

US inflation data is the big ticket item today, expected to come in at +0.6%, up 3.6% year-on-year from 3.2% last month, largely on higher gasoline prices which shouldn’t affect core. In fact the core CPI is expected to show substantial cooling at +0.2% for the month and 4.3% yoy from 4.7% last time out. Either way the Fed is almost certain to pause rate hikes next month - question is about whether it wants to leave one on the table for November. A hot reading could increase expectations and push up front-end yields.

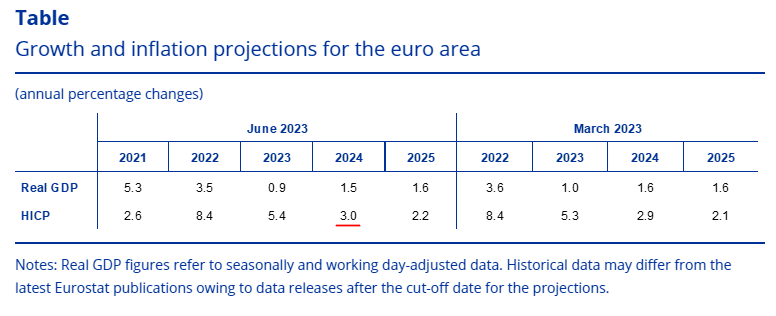

EURUSD is holding above 1.0730 ahead of the ECB meeting tomorrow with sources suggesting that the central bank will raise inflation forecasts for 2024 to above 3%. It’s not normal for the ECB ‘sauces’ to be out and about ahead of a meeting – usually they are wheeled out to mop up after a Lagarde verbal accident. Markets pricing suggest it’s a coin toss whether the ECB hikes by 25bps or stands pat tomorrow.

Meanwhile sterling snapped the Sept 7/8th swing lows to break to a fresh 3-month low after UK economic data again came in weak. GDP contracted by 0.5% between June and July – worse than expected, and in the three months to July it was up just 0.2%. Lacklustre growth , still high inflation and record wage settlements...stagflation o’clock. The Bank of England may hope that next week’s hike is its last. But given the crap summer we had it’s not a massive surprise.

I’ve generally tended to think that the behaviour of equities suggests investors seem to be a bit complacent. Interesting to see that 74% of global fund managers say it’ll be a soft landing or no landing. Here’s a snapshot of some headlines from 2007...