Thursday Nov 14 2024 07:40

6 min

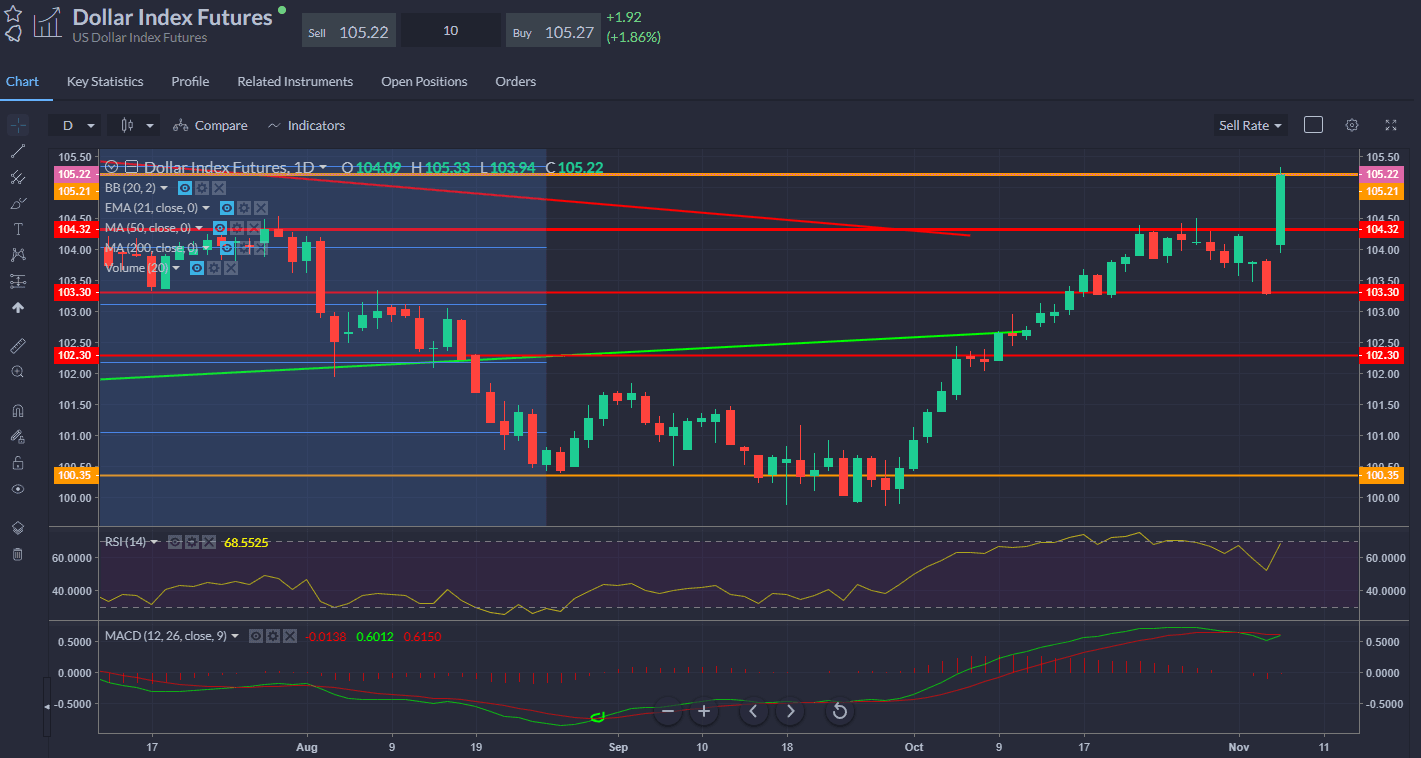

In his victory speech earlier, Donald Trump talked about paying down debt and cutting taxes. I guess the market would be right to think, ‘Well, which one is it gonna be?’ For now, it’s very much risk-on for US equities, and the dollar is back to the highs of the day, with DXY just hitting resistance once more at 105.30. The red wave = a strong US economy, but what about the dollar?

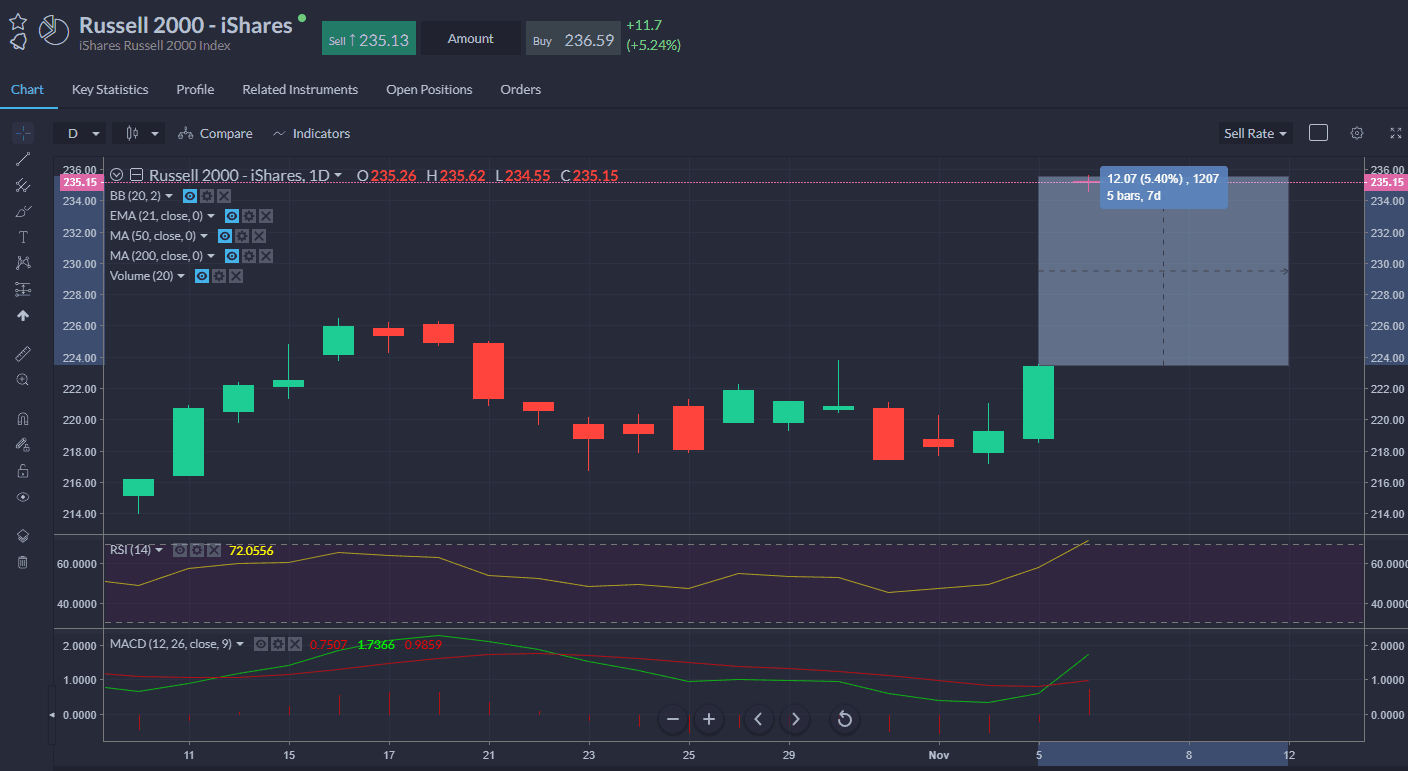

Some very large moves at the open in the US as the Trump Trade really takes off – SPX up 2% for a fresh intraday record high and the Russell 2k gapping up a whopping 5% at the open, with the Dow Jones up more than 1300pts, or 3%, for a new record high.

On the Russell 2k – lots of banks (which are doing very well today on deregulation and steeper yield curves…reflationary, cyclical,) and it's domestic focused, so it is a play on fiscal largesse and is a lot less worried about global outlook: it’s a pure ‘buy US’ trade right there. The KRE regional banks ETF is up 10% at the open for another flavour of how US investors are reacting to the election of Donald Trump.

Only the Sep 19th 2008 TARP proposal and Nov 9th 2020 Covid vaccine announcement have seen bigger gaps higher for IWM (Russell 2k ETF). Russell 2k may be breaking out above 2,400 to take on the 2020 all-time high at 2,458.

The early positivity in Europe has evaporated as quickly as you can say ‘tariffs are my favourite word’. DAX is now down half a percent, which makes more sense given the way how a trade war threatens to weigh on Eurozone growth. The FTSE 100 is also a little lower now into the final stretch of trading today.

We’ve got the US 30-year yield up about 23bps, its biggest move since the pandemic. This is priming the dollar bulls for a one-way trade, and the dollar index is on track for its best day since March 2020.

On the US dollar and chatter about weakening the greenback – we know Trump and co would prefer a weaker dollar, but can they get it?

Here’s what I wrote in July:

Hillbilly Elegy: What does Vance as VP signal about the Trump agenda? I think it means they are going all in – why wouldn’t you! Final term, got the polling lead and momentum...time for courage and to take the country with you. For us in the markets we have to look to trade – tariffs, protectionism and maybe devaluing the dollar? You need to understand where these guys are coming from and what they have been saying forever – globalisation killed American jobs, trading with China is fundamentally flawed...the goal is to reinvigorate places like rust-belt Ohio and the Appalachians by bringing back jobs. It would hurt China for sure. UBS notes that new tariffs of 60% on all Chinese exports to the US would more than halve China’s annual growth rate.

We know that Trump’s former trade chief Robert Lighthizer, who could be the pick for Treasury, has been talking about devaluing the dollar. This should hardly be surprising – we were talking about this during the last Trump presidency when officials toyed with a ‘weak dollar’ policy a bit by talking the dollar down before swinging back behind the ‘strong dollar’ policy that every White House adopts.

Plaza 2.0? Back in the 1980s there was coordinated action taken by leading economic powers to weaken the greenback. What became the G7 group of nations may not be so keen to repeat such a move, although Japan and Korea are concerned about the weakness of their own currencies. Europe is hardly bothered. But the US can act alone if it chooses. This would introduce a dangerous added element (currency) into what’s already a pretty heady mix of economic nationalism (trade, sanctions, subsidies). It could come alongside a weakening of central bank independence, which could further undermine the global financial system. Indeed, Trump may need to weaken the independence of the Fed if he really wants to cut rates a lot more than they plan right now. It would also set off a lot more inflation, thereby reducing the efficacy of bringing jobs back to the US. Trump could shrink the massive fiscal deficit, which would let the Fed cut more. But there is no political support for this –as it involves tricky decisions on spending.

In short, markets should beware that Trump 2.0 could see complementary policy changes that would lead to a weaker dollar, more inflation, and potentially damage investment and trade. It could also make it a lot harder for coordinated international action to happen in future when the inevitable next shock to the global financial system comes along. It may or may not bring back jobs to the Rust Belt, and he may shy away from outright devaluation, but it definitely should be on our radars.

In other words, I don’t really know, but keep an eye open for dollar chatter from the president-elect.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.