Start trading with markets.com

You can trade on any instrument as long as you have enough funds in your account.

Make sure you check your available margin and the margin required for an instrument before you place a position.

After you’ve done so, you can open the position based on the free margin you have.

Find out more below.

You can find your account balance and other financial information at the top right corner of the markets.com platform (usually toggled through the “$” icon).

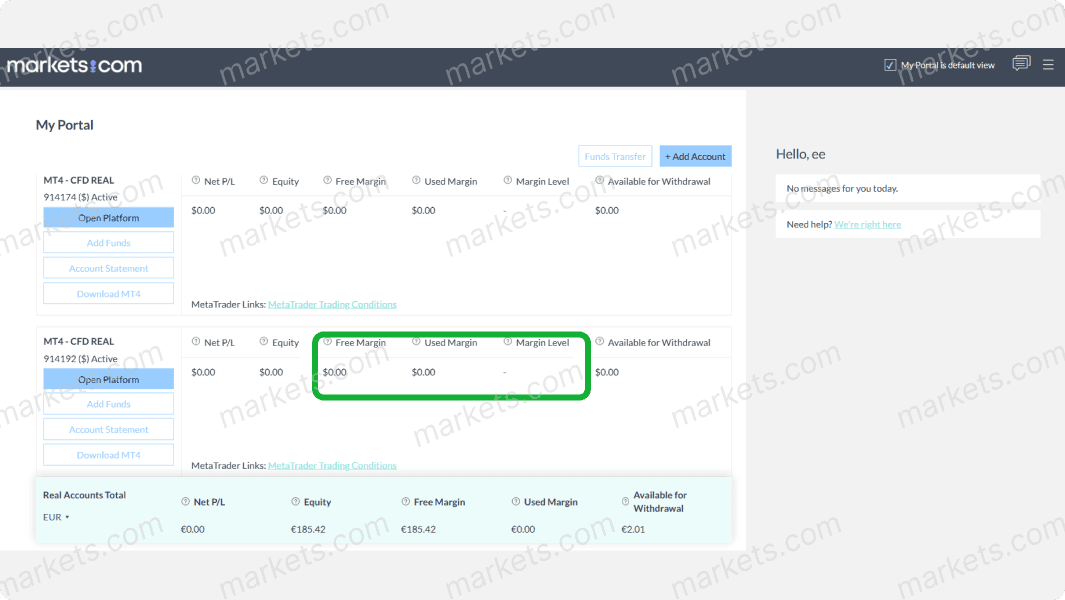

For financial details of your MT4/5 account, go to the top right corner menu and click on “My accounts”.

Bear in mind that the account balance shown does not reflect the profit or loss of open positions.

Find out more about margins in this section.

The required margin refers to the amount required for you to open a position and is derived through the following formula: (volume x current price) / leverage + (volume x spread) = total required margin.

Here’s an example: If you buy 10 barrels of oil at 51.30, then the calculation for the required margin is (10 x 51.30)/100 + (10 x 0.03) = 5.43 USD.

You can check out our CFD trading calculators too.

The used margin is the sum of the margin currently used for your open positions. It is calculated by adding up all of the initial margins of all of your open positions.

You can see the free margin, used margin, and margin level of your trading accounts when you log in and go to “My Portal”.

Here are some instances that need margins.

When trading CFDs, you need to maintain a certain margin level within your account to keep your positions open.

This margin is calculated as a percentage of the total value of your ongoing trades. If your margin falls below this level, then the system may start closing your trades to protect you from further losses - starting with the trade that has the biggest open loss.

Let’s say you decide to hedge your position, meaning to open a position in the opposite direction with the same quantity as your existing one.

Our system will only charge half of the margin required for your existing position and half of the margin required for the hedge position (exemptions apply)

This is a specific type of account offered solely to French clients due to regulatory requirements.

In light of consumer duty, new protections for less experienced UK FFS retail clients concerning GSL orders have recently come into effect.

This type of account means that the maximum potential loss for each of your positions will not exceed the initial margin amount required to open each specific position, including any overnight swap (swap fee) and other charges.

This will be linked automatically to every order that you open, whether it is a market order or a pending order.

When your position's loss reaches this amount, your position will be automatically closed by the system.

These orders allow you to protect yourself against further losses or lock in your profits when you are not able to monitor your positions.

Stop-loss orders limit your loss on a specific level. On our platform, a stop-loss order can be set based on rate, USD value, and percentage of margin.

In contrast, a take-profit order kicks in when the predefined instrument price is reached. You can set the take profit order based on rate, USD value, and percentage of margin on our platform.

Log in to your account now to start trading on instruments.

Start trading with markets.com

Articles in this section

Other Topics

Account registration & verification

Deposit and withdrawal

Getting started with markets.com

Our trading platforms

We've got you covered. Here's how to reach us for personalized help.

Book a free 1:1 training session for focused education and platform navigation to begin your journey with markets.com

We currently cannot accept clients from your country. If you have received this message in error, please contact our support team at support@markets.com.

Contact SupportWe've got you covered. Here's how to reach us for personalized help.