Wednesday Dec 4 2024 06:08

4 min

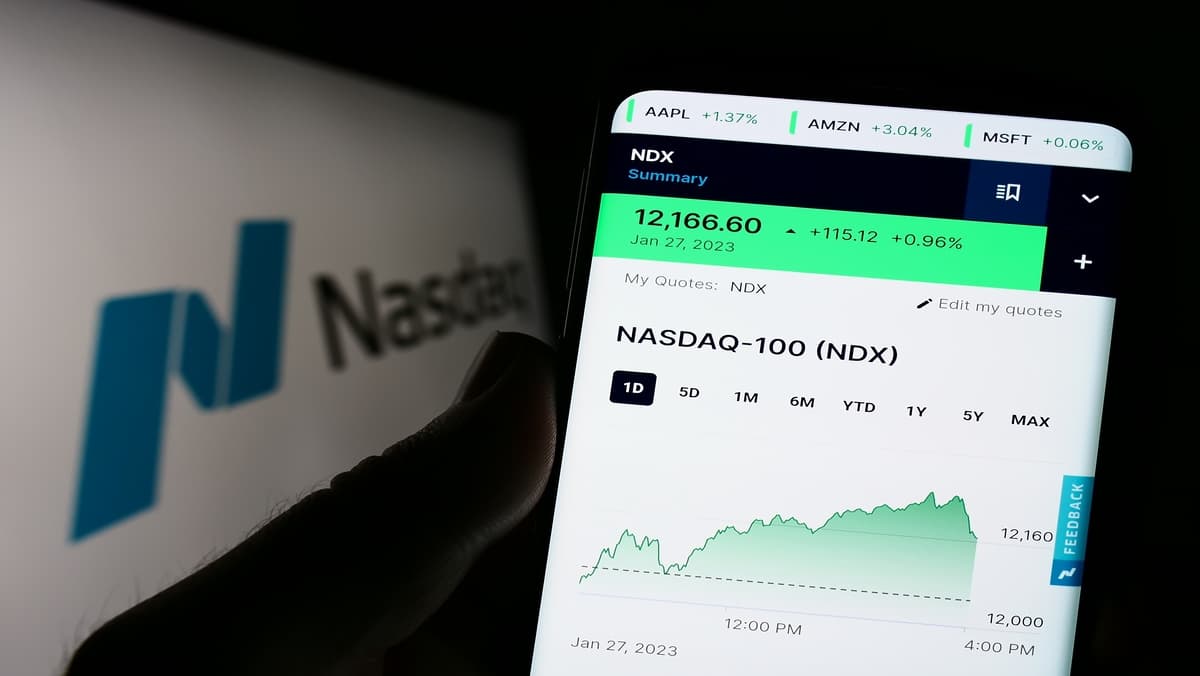

The Nasdaq and S&P 500 reached record closing highs, driven by tech stocks after strong gains in November, investors are now focusing on this week's economic data, including the crucial monthly jobs report due on Friday.

On Monday, both the S&P 500 and Nasdaq Composite were poised to achieve record closing highs, although investors anticipated increased volatility in the days ahead. The S&P 500 climbed 0.3%, supported by the strong performance of major tech stocks, even though only 190 of the index's components were in the green.

The Nasdaq Composite also saw a 0.9% gain, primarily fueled by solid advances in the technology sector. Despite broad market weakness, tech stocks played a key role in driving these indices to new highs, highlighting the ongoing strength of the sector in the face of uncertainty.

The Nasdaq Composite and S&P 500 reached record closing highs, fueled by a strong performance from tech stocks.

The Nasdaq rose 1%, marking its first record close since November 11. The S&P 500 gained 0.2%, extending Friday’s record close. Meanwhile, the Dow, which also set a record on Friday, fell by 129 points, or 0.3%.

The yield on the 2-year Treasury note increased to 4.197%, slightly surpassing the 10-year yield at 4.193%. This inversion of the yield curve signals ongoing uncertainty regarding interest rates, inflation, and economic outlook.

While most of the S&P 500 saw declines, large tech stocks helped prop up the market. This shift marked a reversal from November’s trend, which favored smaller stocks and underperforming sectors over chip stocks and the “Magnificent Seven.” It was a relatively quiet session overall.

Federal Reserve Governor Christopher Waller indicated he is leaning toward a December interest rate cut, but his decision will depend on upcoming data.

The Job Openings and Labor Turnover Survey will be released tomorrow, with the November jobs report on Friday expected to be the most significant release before the Fed's December meeting. A "too-hot" jobs number could influence Fed policy.

Trump's Election Victory and Republican Sweep Boost Stocks in November

Former U.S. President Donald Trump reclaimed the White House in last month's election, and his Republican Party secured control of both houses of Congress, driving stocks higher in November.

On the day, the Dow Jones Industrial Average fell 128.65 points, or 0.29%, closing at 44,782.00. Meanwhile, the S&P 500 rose 14.77 points, or 0.24%, to finish at 6,047.15, and the Nasdaq Composite gained 185.78 points, or 0.97%, closing at 19,403.95. Strategists have pointed to Trump’s potential plans for tax cuts and deregulation as a positive for the stock market, although concerns about tariffs remain a negative factor.

U.S. tech stocks continued to drive market performance, reflecting a strong economic outlook and investor confidence in the sector. Major companies like Apple, Microsoft, and Nvidia posted notable gains, fueled by their dominance in cloud computing, artificial intelligence, and semiconductor technology.

The Nasdaq Composite, heavily weighted with tech stocks, surged 0.9%, bolstered by investor enthusiasm around innovation and growth in the sector.

Tech stocks remain resilient despite broader market fluctuations, with analysts highlighting the sector's potential for continued expansion. The sector is benefiting from advancements in AI, machine learning, and automation, which are expected to transform industries and drive long-term growth. However, potential risks, such as regulatory challenges and global supply chain disruptions, could impact future performance. As tech stocks remain a critical part of the U.S. economy, they are likely to continue shaping market trends in the coming months.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.