Tuesday Nov 19 2024 09:58

6 min

We talk a lot about Musk in the latest Overleveraged pod.

Top Trumps: The search for the key Treasury position continues. Trump has added former Fed Governor Kevin Warsh and Marc Rowan, CEO of Apollo Global Management, to the mix for Treasury Secretary. Hedge fund boss Scott Bessent, transition team co-chair Howard Lutnick, former trade secretary Robert Lighthizer, and Senator Bill Hagerty are all thought to be in the running.

Trump has chosen Liberty Energy CEO Chris Wright as the energy secretary. He’s previously said that ‘there is no climate crisis and we’re not in the midst of an energy transition either… There is no such thing as clean energy or dirty energy’. Suffice to say we know the White House's stance on green energy! And he chose big tech critic Brendan Carr for chair of the Federal Communications Commission. He’s not a fan of big tech, but he’s also not a fan of government regulation. And he is a fan of free speech.

G20 meetings kick off in Rio de Janeiro, with the heads of governments looking at issues like climate change, conflicts in the Middle East and Ukraine, and the imminent presidency of Donald J Trump. The 2024 Summit’s theme is ‘Building a Just World and a Sustainable Planet’. Keir Starmer will meet President Xi of China – closer relations? Who knows…the elephant not in the room is Trump.

In markets, European indices trade are mixed with limited direction early Monday with precious little on the data calendar today or this week. Nvidia earnings will be the main event on Wednesday. Hong Kong closed 0.8% higher amid a mixed bag for Asia.

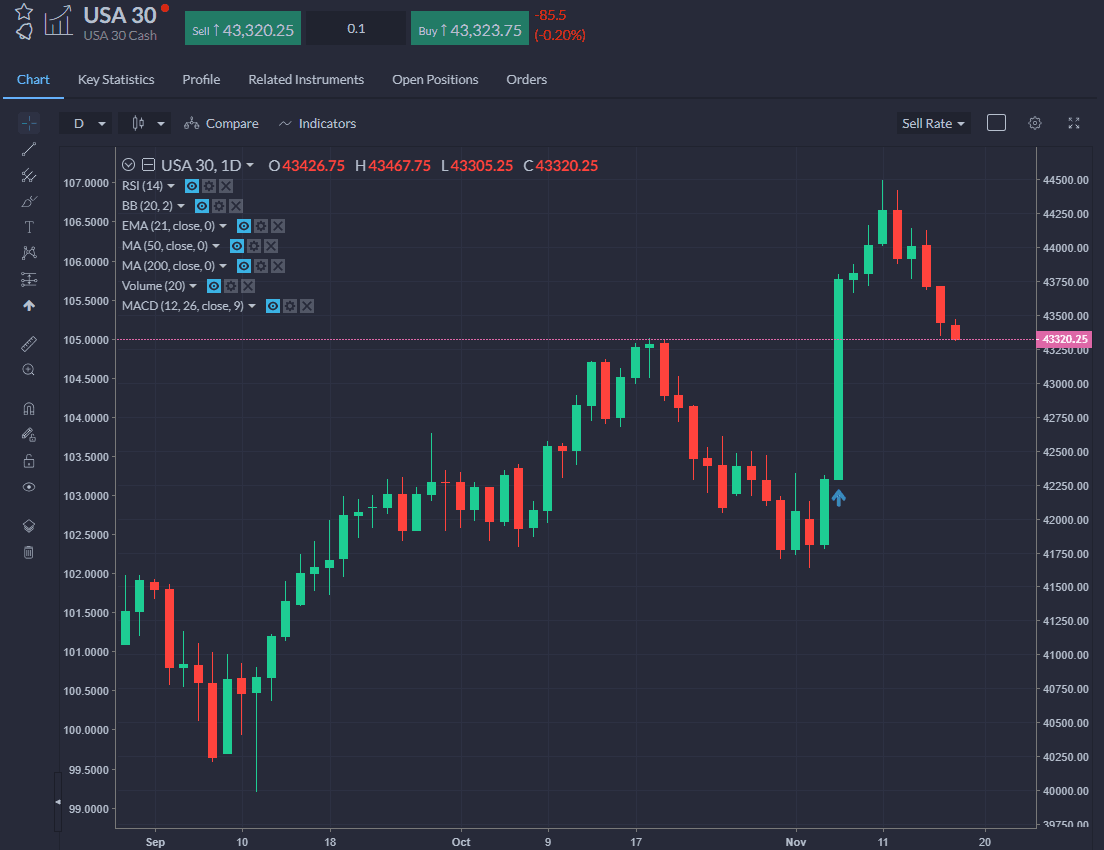

US stocks wobbled on Friday as rate concerns weighed on big tech, and the appointment of RFK Jnr to health apparently dragged on big pharma. The Nasdaq declined by more than 2.2%. The XBI biotech ETF fell more than 5%. Jay Powell said the Fed is not in a hurry to cut rates. Retail sales were a tad stronger, whilst CPI inflation rose in line with forecasts. The major averages were riding high on the post-election Trump trade, hitting new all-time highs on Monday, but traded down on the week as some of the initial fizz came out. There is a definite sense that there was this Trump bounce FOMO momentum trade going on, and no one was really thinking too much about bonds and rates, and now there is a bit of reality hitting.

MAGA trade: Nevertheless, analysis shows European markets lagging the US by a record margin, while the dollar is also surging. It’s a recipe for takeovers – should the US fancy anything in Europe going cheap, that is. The growth premium in the US is startling for good reason - they have it, we don’t. The risk for the US is Trump fires it up too much and they overheat. The reality in Europe and Britain is that we can’t seem to buy growth at any price. Wonky energy policies are not helping. BofA says US$ (real effective exchange rate) now at 55-year high, US stocks vs world at 75-year high. Investors are the highest overweight US stocks in 11 years. Stronger dollar + financial conditions tighter as markets price out rate cuts…not good for RoW. BofA says: “Wall St frontrunning Trump 2.0, so will Main St by Q4/Q1 via labour hoarding & big inventory build ahead of tariffs…means US GDP beats in Q4/Q1 best played via long US$; Wall St also pricing global bust…” The worry for the MAGA trade is rates: if we see the 30yr to 5% (currently ~4.6%), 2yr to 4.5% (currently ~4.3%) then it’s going to create the kind of tightening that produces a hard landing.

And things can turn quickly – beware linear thinking that Trump trade is one-way forever. Here is BofA again: “China to ease fiscal policy & ECB to cut rates aggressively in anticipation of “America First” tariffs…lower rates, cheaper currencies, lower oil prices means big easing of financial conditions in Asia & Europe relative to US…bear sentiment soon to approach “buy humiliation” levels.”

DJIA: losing some sparkle – worries about running too hot?

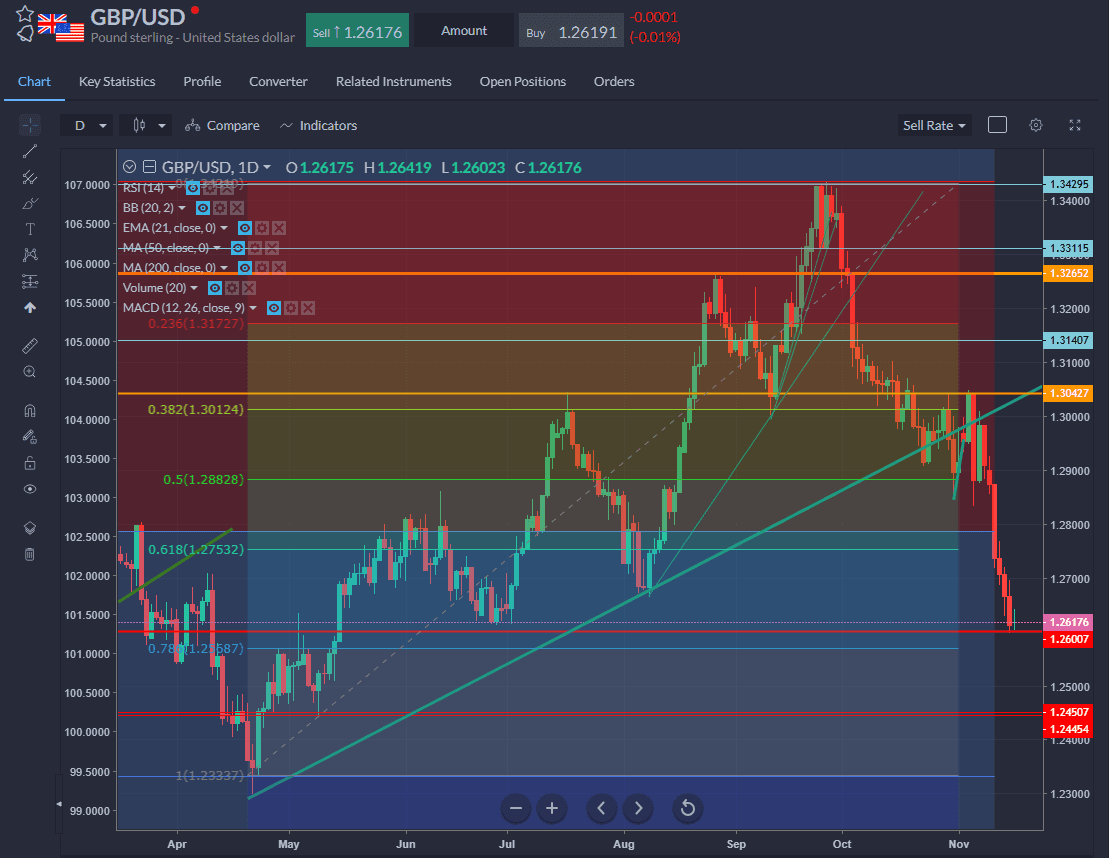

Cable found a bit of a floor at 1.260 on Friday and gapped higher at the Sunday night open but the upside move didn’t last beyond 1.2640 and it doesn’t look too stable here. Could see 1.24 again.

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.